What Business Mileage is Tax Deductible?

Table of Contents

An organized list, with clear explanations, of what the IRS approves as tax-deductible business mileage.

Many self-employed individuals and employees use their car for work and they deduct the mileage driven for work from their taxes. However, there are some gray areas about what is considered to be a tax-deductible business drive.

Do I qualify to deduct business mileage from my taxes?

First, you must determine if you qualify for business mileage tax deductions before you consider taking a tax deduction for business mileage. And, if you are already deducting mileage for business drives, it might be informative to make sure you qualify to do so as well.

To qualify to deduct business mileage from your taxes you must own or lease the car that is being used. To verify this requirement, the IRS requires taxpayers to provide proof of ownership or documentation of the car or truck lease.

For employer-provided cars and trucks, the Standard Mileage Rate method does not apply. However, there are some car or truck expenses that the taxpayer can deduct. The deductions allowed depend on a few factors. These factors include the amount of the vehicle expenses that are covered by the employer and the percentage of business and personal miles driven on the car for the tax year. For detailed information on this topic refer to this informative post, Tax Deductions for Employer-Provided Truck and Car Expenses.

How do you deduct business mileage from your taxes?

There are two methods for deducting business use expenses of cars and vehicles.

- Standard Mileage Rate Method

- Actual Car Expense Method

Only one can be used at a time, you cannot mix and match these two methods. Therefore, pick the one that works best for you. This post is for those using the Standard Mileage Rate Method. For more information about these methods check out this post, How to Maximize Business Use Car Tax Deductions.

Now, to the important part, the part that you came to this post for. The list of what business mileage is deductible. It’s important to have a clear understanding of tax-deductible business mileage if you plan on taking a mileage deduction.

What business mileage is tax deductible?

1. Travel to Different Offices

If your company has more than one office location, such as a location outside of your hometown that is not your regular place of work, travel to this office location is tax-deductible.

However, the key element here is ‘outside of your home town’. A full-time employee who travels to an employer’s office location that is in the same town likely can’t deduct the mileage driven.

For more information on how the IRS defines ‘Away from home’ for determining if business mileage expense is tax-deductible, please refer to this post, IRS Business Travel Definition of ‘Away from Home’.

2. Drives to Meet Clients

These drives fall into two categories

- Client visits

- Meals and entertainment

Many professionals use their cars to meet with clients. These meetings are often at the client’s office. They can be as simple are client visits. Or they are meetings that involve meals and entertainment. Mileage accrued using a personal car for drives for these purposes are tax-deductible. Also, there are tax deductions available for the meals and business entertainment expenses incurred during these meetings. For more information about these deductions refer to this post, IRS Rules for Travel, Transportation, Meals, and Entertainment Expenses.

3. Drives to Airport and Train Station

You need to go to the airport if you’re traveling for business by plane. Therefore, miles that you drive to and from the airport are considered part of your business travel expenses. This means that these miles are tax-deductible. The same applies if you are traveling for work by train and you use your car to drive to the train station.

4. Errands (i.e. Bank, Office Supplies)

When you use your car to drive to get office supplies or to run errands for business, the miles driven are tax-deductible. Other

5. Temporary Work Location

A temporary work location is defined as a location for work that is expected to last a year or less. If you use your car to drive to a temporary work location using your car then these miles are tax-deductible. There are quite a few nuances behind what defines a temporary work location so be sure to be knowledgeable about them before considering to deduct miles for this type of drive. With that said we have created an informative and easy-to-read post, Temporary Work Locations & Commuting Expenses Tax Deductions, which clarifies those nuances.

7. Odd Jobs

Drives to any side jobs, such as babysitting, house cleaning, gardening, landscaping, etc. that you use your personal car for in order to get to and from at tax-deductible. With that said, keep a detailed mileage log of these drives.

Please note tolls, parking fees and other transportation expenses incurred during work trips are also tax-deductible as business transportation expenses.

What mileage expenses are not tax deductible?

An employee’s regular commute to and from their regular office is not a tax-deductible mileage expense.

For example, if you use a bus, subway, or taxi to commute between your home and office, these costs would be considered personal expenses. Further, even if you do work during your commute, you cannot deduct the commuting expenses. Also, parking fees and/or tolls incurred during your daily commute are also not tax-deductible expenses.

What records are required to take a mileage tax deduction?

You can’t just submit the number of miles that you drove to the IRS and expect to get a tax deduction. You need to provide documentation. The IRS requires a detailed mileage log that includes the following information:

- the miles you drove for business (ie your mileage)

- the places you drove for business

- the business purpose of your trip

- the date of your trip

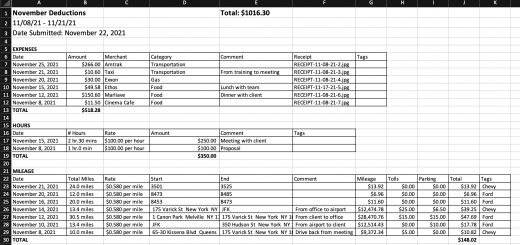

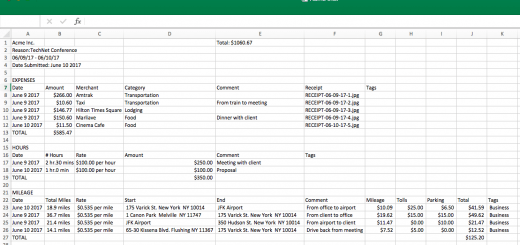

Check out this post for more information about creating mileage logs, Mileage Reports, What’s Required. Also, Falcon Expenses offers a great mobile app solution for collecting mileage expenses and creating mileage logs.

Home Office Mileage Deductions

You can take a tax deduction for mileage driven from your home office to any other location that is for business. This is because when you work from home, any miles driven are not considered commuting expenses. When you work from a home office your qualify for extra tax deduction benefits that fall under self-employment tax deductions.

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data to email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com