Receipt Management for Business Expenses

Table of Contents

Do you misplace paper receipts for expenses? Read for the perfect solution.

Receipt Management: The Painful Back Story

You likely have experience with misplacing cash receipts if you’re self-employed or an employee that regularly submits expense reports.

Often, receipts are required by your accountant or employer for IRS-compliant recordkeeping or reimbursement.

Delivery drivers, freelancers, small business owners, etc. forget where they’ve put business expense receipts.

Also, for the paper receipts you haven’t misplaced, you likely need to tape each one to paper and scan and send to your accountant or manager.

The entire receipt management process is cumbersome and time-consuming.

There’s a better way.

What are IRS receipt recordkeeping requirements?

Proper recordkeeping is important for preventing an IRS audit and being prepared in the event of an audit. Adequate records require that a log of the expenses be kept along with documentary evidence (i.e. such as receipts) of individual expenses. However, there are a few exceptions. Such as, expenses under $75 that are not lodging expenses and do not require a receipt. Also, transportation expenses that do not readily have a receipt available, don’t require a receipt.

The basis for an adequate expense record, and receipt management, is if it contains the following information:

- amount

- date

- place

- purpose

For a complete guide of the details on what you need to keep for each expense type, check out this post: IRS Rules for Recording Business Expenses: Travel, Transportation, Meals

Are receipts pics proof of purchase?

Paper receipts serve as proof of purchase. Pictures of paper receipts also serve as proof of purchase and are less prone to misplacement or damage. Falcon’s receipt keeper safely stores proof of the business expense purchase beyond the cryptic details that are found on a credit card statement.

Do Everything from a Phone

Use Falcon Expenses to capture pictures of receipts on the go. You simply open their phone and snap pictures of business expense receipts. All of your receipts are safely stored in one place and can be quickly organized into downloadable reports that can be emailed to anyone, at any time. All from your phone. This is more efficient than waiting to get back to the office to enter all of the receipt data into a spreadsheet. In any event, by the time you get back to your office, you have likely misplaced many of their receipts.

With Falcon Expenses, you capture pictures of receipts as you get them. All receipts are safely stored inside Falcon Expenses. Falcon Expenses provides a solution to keep every business expense receipt, along with the amount, date, place, and purpose associated with the receipt images. You can also add custom tags, purpose, and categories.

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

Falcon Expenses Receipt Management Features

Streamlined Entry of Receipt Data

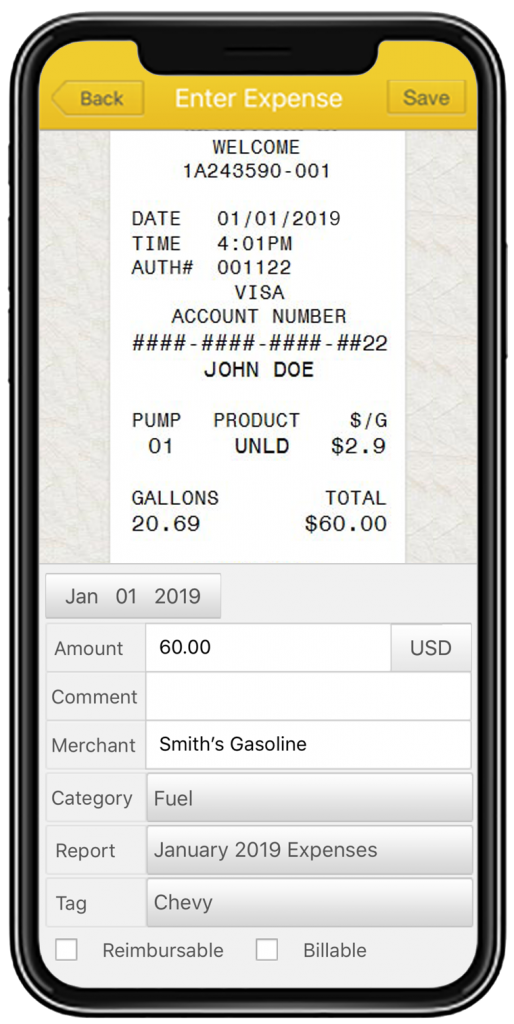

Receipts uploaded to Falcon Expenses via the Enter Expense form are displayed on the top half of the screen. Further, below the receipt image on the bottom half of the screen is the expense form. The expense form is where expense information from the receipt is entered.

This information includes:

- purchase date

- expense amount

- merchant

- comment

- purpose / categories

- tags

Dedicated Field for Expense Purpose (That’s Not the Back of the Receipt)

Adequate record keeping requires a reason is given to deduct certain business expenses. Usually, you would scribble the reason on the back of the receipt then crumple it up and put it in your pocket to be lost later. Therefore, a better approach is to use a mobile solution like Falcon Expenses. With Falcon Expenses, add the reason or purpose for each business expense directly into the comments field located on the form. Further, receipt logs are exported in

Inside each expense report is a column dedicated for a system-generated receipt name. The receipt is named by the date entered by the user for the receipt. If more than one receipt has the same date, then the end of the system generated name is appended is a number, starting with one. Lastly, after the expense summary page, which is the top page of the expense report, the receipt images are attached. If you are exporting in PDF format, each receipt photo is attached to the pages that follow. Up to four receipt photos can be attached to each page. Further, receipt image names are located above each image. These names can be used to reference the expense data located in the report summary located on the first page.

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

One-Tap Report Generation

Once you have entered all your expenses all you have to do is select the ones you want and download them as a report. Create reports for anything you like, such as by time period (ie week, month, etc.), trip, project, etc. Email reports to anyone from your phone.

Easy-to-Read Reports

Export easy-to-read reports in PDF and/or spreadsheet format from Falcon Expenses. These reports contain a summary of all of the expenses, which includes the date range of all expenses and the summation of the total amount of the expenses included in the report. Below the report summary is the detail of each expense such as amount, date, rate (for mileage or billable hours), miles driven, tolls, and parking. Also, receipt images are attached below each expense summary and referenced in the report summary for easy location. For more information about what report exports from Falcon Expenses look like please review this post: What exported reports from Falcon Expenses look like.

Falcon’s Receipt Management Benefits

Never Lose a Receipt Again

Use Falcon Expenses to capture a picture of the receipt so that it is safely stored and never lost instead of putting the expense receipt in your purse or wallet for later recording. Therefore, you always maximize your expense reimbursement (or deduction). Also, you always keep your accountant or manager by having accurate and complete documentation of your records.

Safely Store Receipts in One Central Place

By keeping photos of your receipts stored in Falcon Expenses you have all of your receipt photos stored in one, central place. Enter receipt data at the time of taking the photo, or do it later. Further, if you are want to save extra time and money, use Falcon Expenses premium receipt scanning feature and we will enter the merchant name, date, and amount for you.

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

More Efficiently Organize Expenses

With Falcon Expenses organize your receipts on the go, and in one place. View your receipt images above the data entry form on your screen as you enter the data as opposed to constantly having to look down at your desk, back-and-forth, as you enter the data. Scroll through the receipt image above the form to scroll to the information that you need as you are entering the data.

Save Time and Money

Falcon Expenses empowers you to be able to do your expenses all from your phone. Do your expenses on the go or as needed versus the old traditional disparate and time-consuming method, which is prone to loss and error.

How to Use Falcon Expenses to Manage Receipts

If you haven’t already downloaded Falcon Expenses, please do so. You need to app to complete the steps below.

- Open Falcon Expenses, select ‘Enter Expense’.

- To attach a receipt image, tap on the camera icon located on the center of the upper half of the screen.

- Enter the amount, date, and a comment (i.e. lunch with clients) in the form fields below the receipt image. Tap and scroll through the receipt image as needed. Add a category, and/or

custom tag, both are optional. Also, select a report to add the new expense to, or create a new report. - Tap ‘Save’, located in the upper right. That’s it!

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data for email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com