Mileage Report, What’s Required & How Falcon Expenses Can Help

Table of Contents

Deduct over $6000 in mileage expenses if you drive just 40 miles a day for business each work day of the year.

For many self-employed sole proprietors or independent contractors keeping a mileage report of your business mileage expenses is a must if you use your car for business. Further, a mileage report is necessary to take advantage of vehicle write-offs. We wrote this article to provide you with a complete guide on mileage expense log requirements. Therefore, you make sure your mileage log meets IRS requirements and you maximize your take-home income.

This post applies to those using the standard mileage rate tax deduction method. If you use the actual car expenses deduction method or you want to learn about the difference between the two, read this post:

The Standard Method vs The Actual Car Expense Deduction Method

What’s required in a mileage report?

The IRS requires you to keep a detailed log of your miles if you want to deduct mileage expenses from your taxes, whether it’s a 1099 or a Schedule C, etc.

What should be included in a mileage report?

The following should be included in your mileage report:

- the miles you drove for business (ie your mileage)

- the places you drove for business

- the business purpose of your trip

- the date of your trip

You can keep a mileage report by hand, or in an excel spreadsheet.

However, both of these methods are prone to error or misplacement and are time-consuming.

Or, avoid all problems with error and misplacement by using an app like Falcon Expenses.

Falcon Expenses is mobile mileage expense tracker app that is more efficient and more accurate than any current method you’re using for mileage tracking (including other apps).

With Falcon Expenses, all of your business mileage expenses are securely saved until it’s time for you to prepare your mileage log for your taxes, your manager, your accountant, or whoever.

Falcon Expenses has 3 ways to log mileage expenses

- Automatic GPS mileage tracker

- Odometr log

- Business trip addresses*

*Falcon automatically calculates distance between start and end addresses

Download Falcon Expenses, Free

If you’re on a desktop it’s best to use your phone to search for Falcon Expenses on the app store.

Trip addresses to calculate mileage expenses

Falcon Expenses ‘Addresses’ feature gives you the ability to enter the start and end addresses of your business trip. From these addresses, Falcon calculates your distance driven. Further, Falcon uses your mileage distance to calculate the amount of your mileage write-off. To calculate this, Falcon Expenses uses the mileage reimbursement rate you set. This makes creating a mileage report easy and less time-consuming.

IRS Standard Mileage Rate Deductions

The standard mileage expense reimbursement rate is a rate specified by the IRS annually.

You can find a chart of these reimbursement rates in this article:

IRS Standard Mileage Rate Tax Deductions.

This is the most popular feature. The start and end address you enter and the total miles that were

Email your mileage report to anyone or yourself whenever needed, all from your phone. For example, at the end of the

Add a comment to each expense, in your comment include the reason for your trip. This will be included in the report export your email to yourself, your accountant, or your manager from your phone.

Download Falcon Expenses

If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

Auto GPS mileage tracker

With the automated GPS tracker, your mileage expenses are tracked as you drive. You simply tap the start button before your trip, and the stop button at the end of your trip. After, the mileage distance you drove is calculated and added to your mileage log. In addition, the start and end addresses of your trip are included in your mileage expense log.

Most importantly, this information is safely saved for you when for when you need to report them. Lastly, the amount of the mileage expense is calculated based on the mileage expense reimbursement rate you have set. The standard mileage expense reimbursement rate for 2019 is $0.58 per mile.

Further, add a comment to each expense you save, in your comment add the reason for your trip or any important information. This comment is included in the mileage expense log export that you email to yourself, your accountant, or your manager.

Download Falcon Expenses

If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Odometer log

This one’s pretty straightforward and probably the method most people who currently keep a mileage log by pen-and-paper use. With this method, you enter the start odometer reading at the beginning of your trip and the end odometer reading at the end of your trip. After, Falcon Expenses will calculate the expense reimbursement amount based on the mileage expense reimbursement rate you have set. For 2019 the standard mileage expense reimbursement rate is $0.58 per mile.

Use the comments field to add a comment to each expense you save. More specifically, in your comment add the reason for your trip. Most importantly, this is included in the report export that you email to yourself, your accountant, or your manager from your phone. Furthermore, for the odometer feature, the comments section is a great place to add the destination of your trip. In addition, it is also the ideal place to add the reason for your trip. Similarly, you can also use the tags feature to add the destination of your business trip. See the section directly below for details about how to do this.

Use custom tags & categories to add important trip details

Each of these three mileage expense logging features includes the ability to add custom tags and categories. For example, use the tags feature to add any number of custom tags to your expense. This helps you in your record-keeping and further reduces the likely hood of an IRS Audit. Created tags for project codes or names, customers’ names, locations, or anything that you want. Also, add pre-built-in categories or create your own custom categories to add more recordkeeping details to your mileage logs.

Tips on keeping a mileage expense log

- Use an expense tracking app like Falcon Expenses, this will make your life a lot easier. Learn more about Falcon Expenses, here.

- Make it a habit to log your business mileage details as they occur

- If you’re behind a few days, or months, use Falcon Expenses addresses feature to catch up.

Certainly, it’s much better than guessing at your odometer readings, which the IRS likely looks down upon.

How do I export my mileage reports?

Export all your mileage expenses into easy-to-read reports in PDF and/or spreadsheet format after you have saved them. And, do this all from your Falcon Expenses app installed on your phone.

To see what exported reports look like visit this page, What Emailed Reports Look Like.

The following information is included in the exported report for each mileage expense type that you save:

- Addresses Mileage Expense: start and end (destination) address of mileage expense, total miles

driven , comments (i.e. reason), tags (i.e. project code, customer), and category (i.e. transportation) - GPS Tracked Mileage Expense: start and end (destination) address of mileage expense, total miles

driven , comments (i.e. reason), tags (i.e. project code, customer), and category (i.e. transportation) - Odometer Mileage Expense: start and end odometer readings of mileage expense, total miles driven, comments (i.e. reason, destination, etc.), tags (i.e. project code, customer, destination), and category (i.e. transportation)

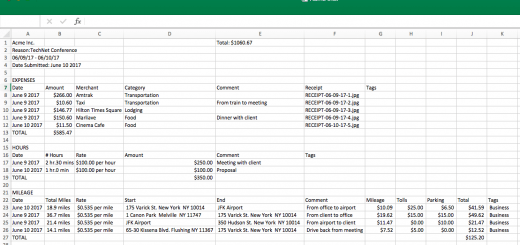

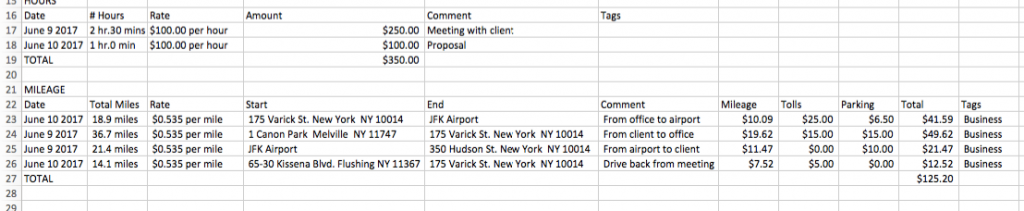

Mileage Expense Report Excel

Wondering what an IRS compliant mileage expense report should look like?

Here is a mileage expense report example in excel.

This example is an excel expense report with mileage logs.

This report is also great as a gas mileage expense report template.

To create this report, your mileage data is automatically captured on your phone, then your mileage expense is calculated. The report your email export from your phone looks like this image above.

Download Falcon Expenses and get started creating IRS-compliant mileage reports.

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data to email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.