How to Keep an Odometer Log of Business Mileage Expenses

Table of Contents

The IRS requires taxpayes to keep an odometer log to write off mileage expenses. Learn how to keep an odometer log.

Introduction

Falcon Expenses is a fully mobile expense tracking and reporting app for business expenses. In addition, entering odometer readings to keep an odometer log and odometer report is one of the key features. This post is about how to use the odometer logging feature to capture and log odometer readings.

Falcon Expenses offers many other features to capture and log business expenses such as a receipt scanner, cash expenses tracker, GPS mileage tracker, and a time logger for billable hours.

IRS Odometer Log Requirements

If you’re using the standard mileage rate method the IRS requires you to keep a detailed mileage log to deduct mileage expenses from your taxes. Whether it’s a 1099 or a Schedule C, etc., a detailed log of your miles driven for business is required.

With that said, the following should be included in your mileage report:

- the miles you drove for business (ie your mileage)

- the places you drove for business

- the business purpose of your trip

- the date of your trip

You can keep a mileage report by hand, or in an excel spreadsheet. However, both of these methods are either prone to error/misplacement and time-consuming. Or, you can use an app like Falcon Expenses. An app like Falcon Expenses is more efficient, less prone to error. Further, all of your business mileage expenses are securely saved until it’s time to prepare your mileage for your taxes. Falcon Expenses is a fully mobile expense tracking and reporting solution for iOS.

If you are not familiar with the two methods available to deduct business use of your vehicle, truck, or car, please review the following post.

How to Maximize Business Use Car Tax Deductions: The Standard Mileage Rate Method vs The Actual Car Expense Method

This post will provide you with an overview of each method. Including, what is required under both methods. Therefore, you can choose which one will work best for you or your business.

Create an Odometer Log

If you have not already downloaded Falcon Expenses, please do so. This will help you to complete the steps below.

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

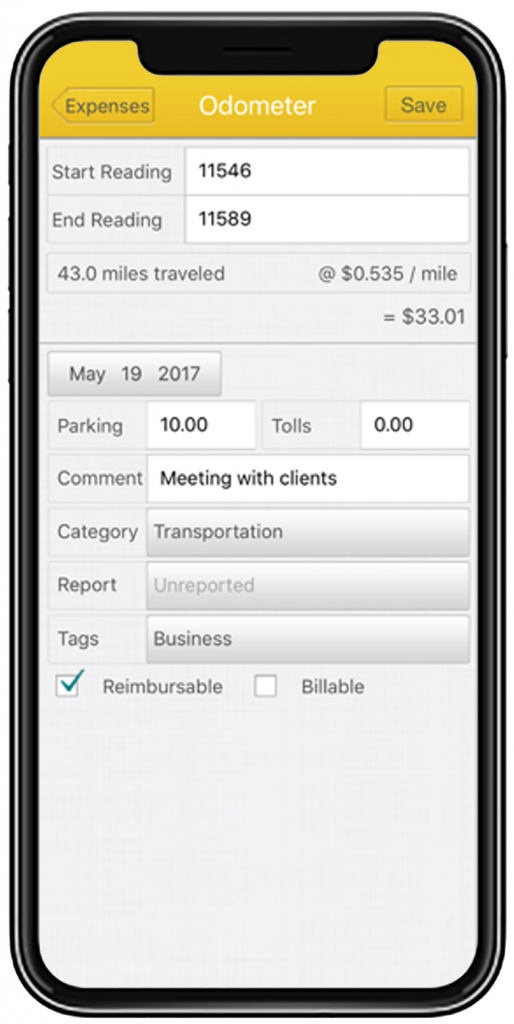

- Open Falcon Expenses, select ‘Track Mileage Expenses’, then select ‘Odometer’.

- Enter your start and end odometer readings. You can also wait to enter your end odometer readings until the end of your trip. Falcon remembers the start odometer reading that you enter so that it is there the next time you open the app.

- Enter the reason for your trip in the comment field. Add a category, and/or a custom tag, both are optional. Also, select a report to add the new expense to, or create a new report.

- Tap ‘Save’, located in the upper right. That’s it!

Click Here to Download Falcon Expenses

If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Falcon’s Odometer Log Benefits

Measures Driving Distance

After you enter start and end odometer readings, Falcon calculates the driving distance between the two readings. Therefore, you no longer need to use a calculator (or to do that math yourself) to calculate this distance.

Calculates Mileage Expense Amount

The amount of your mileage expense is automatically calculated for you, leaving yet one less step for you. The expense amount is calculated from the mileage expense reimbursement rate and the distance of the mileage expense. Further, the expense reimbursement rate is set by the user. Currently, the standard mileage expense reimbursement rate is $0.58. However, you can set your mileage reimbursement rate to whatever you would like.

Organized Mileage Expenses

All of your expenses remain safely organized in your Falcon Expenses app. You can view them by date, project, client, tag, etc. You can sort and filter them however you need to all from your phone.

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

Categorized and Organize Mileage Expenses

With Falcon Expenses, assign one category to each saved expense and as many tags as you would like. Also, use tags to add necessary details to your expenses for proper record keeping. For example, create custom tags based on client names, projects, project codes, destinations, and more. Also, add a category such as the type of drive. For example, personal or business. Or, create a custom tag, even delete a tag that you no longer need. The options are endless. Lastly, you can edit the date to the date the expense was incurred using the date editor that is located on each expense entry form. Most importantly, the details you need for your manager, client or whoever, will be there.

Use Falcon On-The-Go

Falcon Expenses resides on your phone, after all, it is an app. With that said, you can add, edit, and manage your mileage expenses from anywhere. Falcon Expenses is fully mobile, this means that you have a full set of expense management features in the palm of your hand.

How do you create a mileage log?

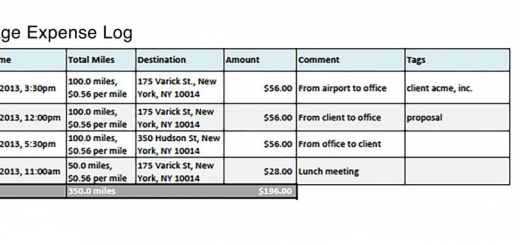

After you’ve entered all of your mileage expenses you can create a mileage log report and email to anyone from your phone. You can create a report to give to your employer after a business trip, or to give a log of your mileage expenses to your accountant at the end of the year. Essentially, you can create a mileage expense report for any of your needs.

Reports can be exported in PDF or spreadsheet format, or both. Report exports include the data that you entered. Also, it includes the information that was calculated by Falcon when you created the mileage expense. The information that is calculated by Falcon includes the number of miles driven and the mileage expense reimbursement amount. The other information included that you entered is your start and end odometer, tolls and parking, comments, tags, categories, etc. It is all there! You can export all of this data by email, to anyone.

Please review the following post for more information about how to create a mileage report: How to Create a Mileage Report with Falcon Expenses.

Reports can be emailed to anyone from your phone. This post will cover how you can do that. Don’t forget to check out Falcon Expenses today, we promise you won’t be disappointed.

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data for email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.