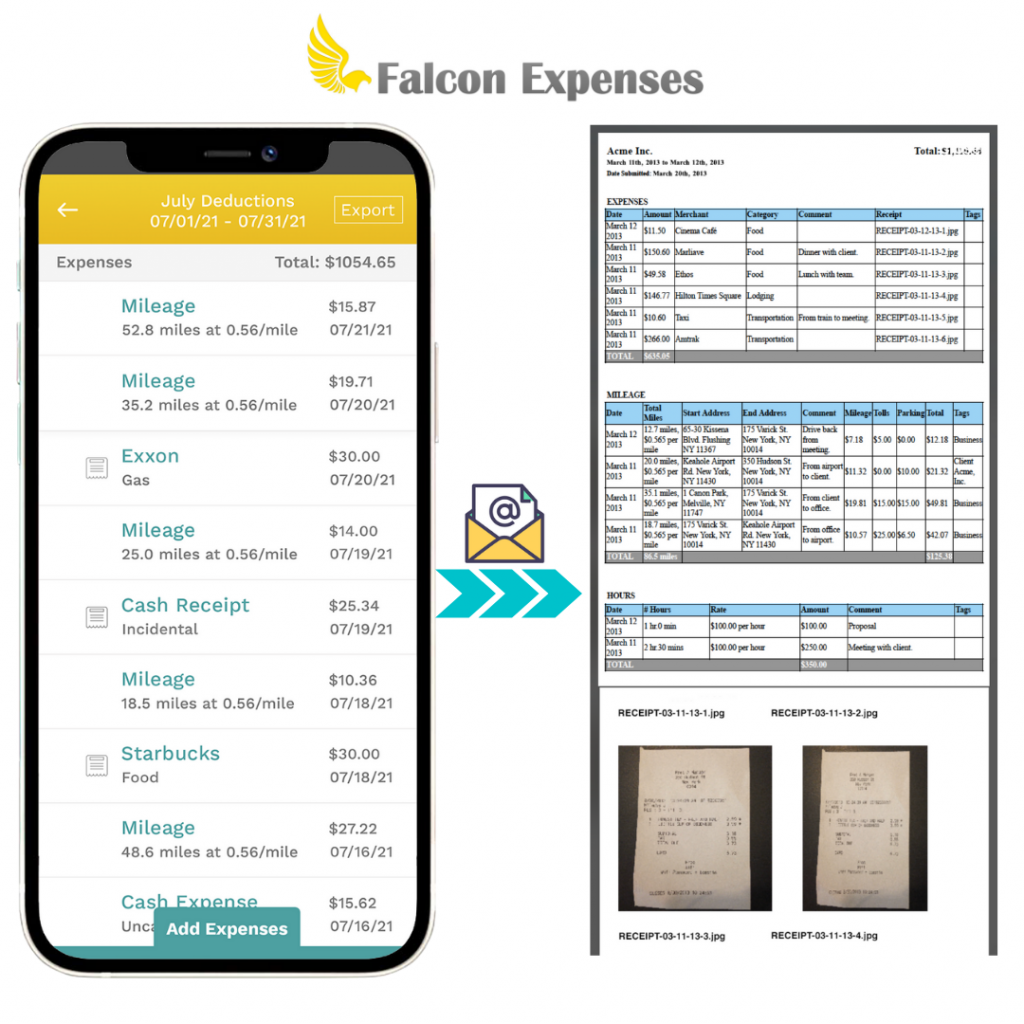

Falcon’s Expense Report Template & What Exported Reports Look Like

Table of Contents

Falcon’s mobile app expense report template meets IRS recordkeeping requirements. Learn what’s included.

Introduction

Falcon Expenses is a mobile app for mileage and expense tracking and reporting. Falcon customers, on average, record over $6,600 in annual tax deductions.

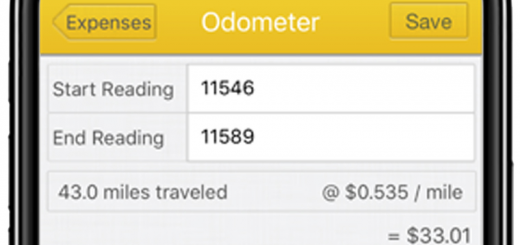

This aricle is about what expense reports look like that are exported from Falcon Expenses using Falcon’s expense report template. Use Falcon Expenses to automatically track mileage expenses, keep an odometer log, log billable hours, and as a receipt keeper.

Download Falcon Expenses, Free

The longer you wait the more tax deductions and reimbursements you miss.

If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Expenses entered into Falcon’s mobile expense app are organized into easy-to-read expense reports. Export reports when you’re ready to do your taxes (great for self-employed) or submit them to your manager or accountant.

If you’re a delivery driver and need an optimal way to track your vehicle expenses by vehicle or by 1099 employer, please check out the following articles:

- Simplified Ways to Track and Organize Vehicle Expenses

- Effortlessly Organize 1099 Expenses by Employer

How to create expense reports?

Falcon Expenses mobile app autogenerates an easy-to-read expense report with all required expense data. For example, merchant name, date, and the amount each have their own dedicated columns in the report export.

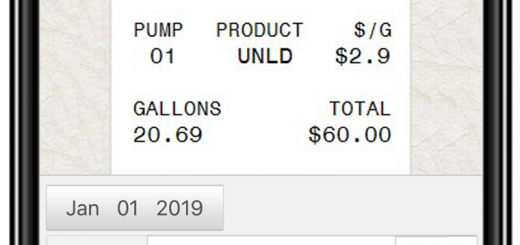

In addition, for cash expenses, a picture of the receipt taken with your phone and attached to the cash expense entry. This is valuable when a record of your paper receipts is required. Each receipt image is included in the expense report export alongside the data entered for the expense. Basically, Falcon auto-populates the expense report template with your expenses and expense data.

After, export your reports via email to anyone all from your phone. For example, email expense reports to a manager, employer, client, boss, accountant, etc. Or, email them to yourself monthly, quarterly or yearly, to use for tax preparation at the end of the year.

For more information about Falcon Expenses mobile expense report app features please review the following posts:

- Accurately Track Mileage Expenses with Falcon Expenses

- Never Lose a Receipt Again: Capture Cash Expenses & Receipts Pics with Falcon Expenses

So, what exactly do Falcon expense reports look like?

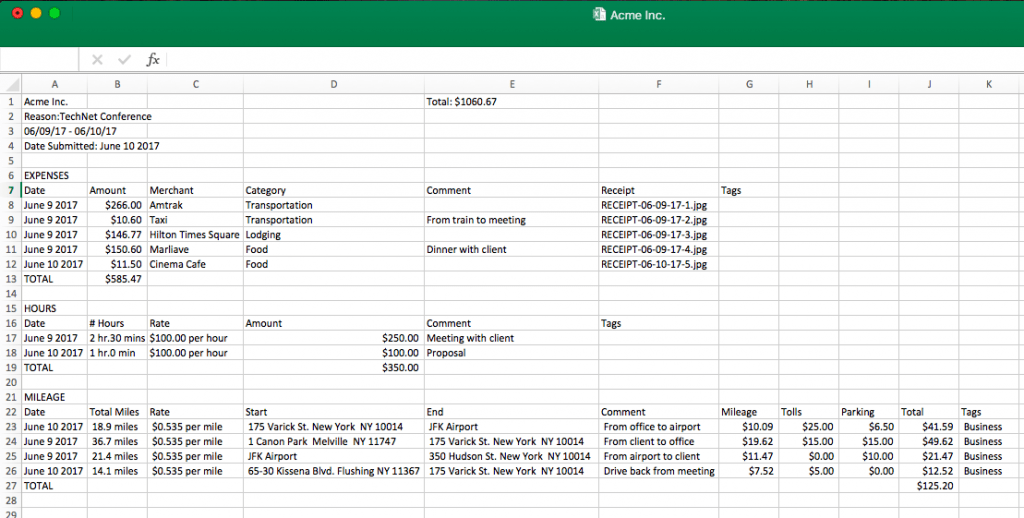

Falcon Expenses offers two formats for exporting expense

- Spreadsheet

Excel Expense Report Template and Export

The expense report export for excel contains a summary of the expense data in excel. This makes it easy for the reviewer (i.e. an accountant, manager, or boss) to manipulate the data.

The image below shows the email attachment received by the recipient after an excel expense report was submitted from Falcon Expenses mobile expense tracker app. This is how the attachments appear in the recipient’s inbox. Included in the attachments is a summary of the expenses, which are in the expense report template for excel. Receipt images are individually attached to your emailed report export for expenses that contained receipt images. Quickly download the receipts with one click for storage and safekeeping.

Below is what an email looks like with both CSV and PDF report formats attached. In this

Download Falcon Expenses, Free

The longer you wait to get started with Falcon the more tax deductions and reimbursements you miss.

If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

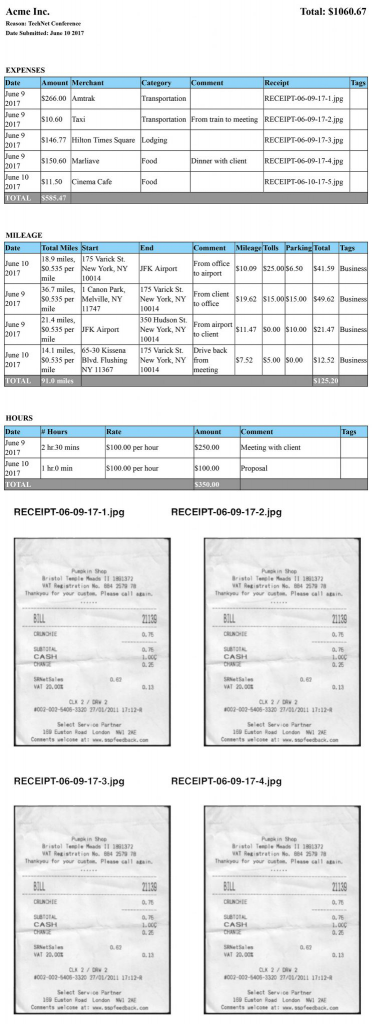

Expense Report Template PDF Export

PDF expense report exports include the expense report summary and the receipt images in one PDF file. Thus, in one attachment. Further, the first page of the PDF expense report export includes an organized summary of all of the expense information. Also, attached as four images per page after the expense report summary page

Download Falcon Expenses, Free

Falcon customers, on average, record over $6,600 in annual tax deductions. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Columns Contained in Spreadsheet and PDF Expense Summary Include

For cash expenses …

- date

- amount

- merchant

- category

- comment

- receipt (the receipt image that the user took a picture of with their phone)

- tags (you can add more than one tag)

For mileage expenses …

- date

- total miles

- rate (i.e. the reimbursement rate per mile)

- start (i.e. start address and end address or start odometer readings and end odometer readings)

- end (i.e. start address and end address or start odometer readings and end odometer readings)

- comment

- mileage (i.e. the total amount of the mileage expense)

- tolls

- parking

- total (i.e. the total amount of the mileage expense including parking and tolls

- tags (you can add more than one tag)

For billable hours …

- date

- number of hours

- rate (i.e. amount charged per hour)

- amount (i.e. the total amount of the expense)

- comment

- tags (you can add more than one tag)

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

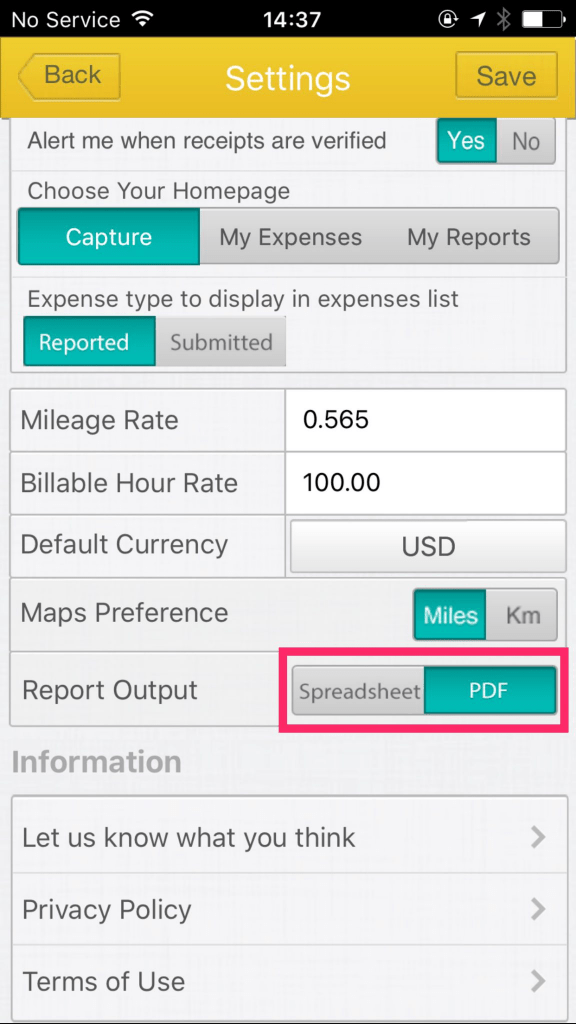

What are the different report export settings?

Set Falcon Expenses to export only the PDF format or only the spreadsheet format. Or, set Falcon Expenses to export BOTH the PDF and the spreadsheet formats. To do this, tap on the Settings icon located in the top right of the yellow navigation bar. Scroll down until you see the option, ‘Report Output’. There, you will see two options: Spreadsheet and PDF. The option(s) is the color teal when selected. See the image below for a screenshot of this section on the settings page. Squared off in red is the ‘Report Output’ section.

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Other

Lastly, for detailed information

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data for email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, delivery drivers, freelancers, realtors, couriers, business travelers, truckers, and more.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.