Employer Tax Deductions of Employee Expenses: How to Deduct

Table of Contents

How an employer deducts employee business expenses depends on the plan use. Regardless of using a reimbursement or per diem plan.

Accountable Plans*

What is an accountable plan?

An accountable plan is an expense reimbursement plan that follows IRS guidelines for reimbursing employees and workers for expenses. Under an accountable plan, reimbursed expenses are not considered taxable income.

Accountable Plan Overview

Expenses deducted under an accountable plan must be deducted as travel, meals, or entertainment expenses. Further, each employee must have paid or incurred deductible expenses while performing services as an employee of the company. Lastly, each employee must return any excess reimbursements within a reasonable amount of time.

Most importantly, each employee must adequately account to their employer for these expenses within a reasonable period of time. According to the IRS, under a reimbursement

Check Out Falcon Expenses

Falcon Expenses is a fully mobile expense tracking and reporting solution that can help you with your accountable plan. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store. It’s free to try.

What about per diem arrangements?

Per diem arrangements are when the company advances money to employees for business expenses in advance. Under a per diem arrangement, additional requirements must be met. Such as the advance must be reasonably calculated not to exceed the amount of anticipated expenses. Also, the business must make the advance within a reasonable period of time. A reasonable amount of time for reporting expenses under an allowance plan is within 30 days. This means 30 days from the time the employee pays or incurs the expense. In addition, excess reimbursements must be returned within 120 days after the expense was paid or incurred. Also, the company must give a periodic statement (minimum quarterly) to employees that ask employees to adequately account for outstanding advances. This statement should notify employees that they have 120 days from there date of the statement.

Learn how Falcon Expenses can help you, whether you’re the employer, employee, or self-employed, log and track business expenses. Falcon Expenses is a fully mobile expense reporting app. With Falcon Expenses, scan receipts, enter cash expenses, track mileage expenses and log billable hours.

- Scan and Manage Receipts with Falcon Expenses

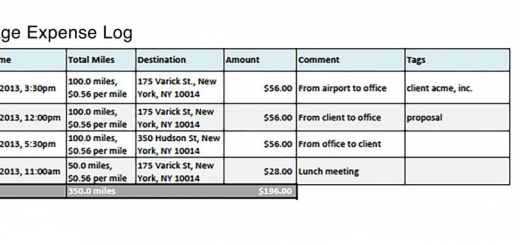

- Track Mileage Expenses with Falcon Expenses

- Expenses Expense Report Template & What Expense Reports Look Like

- Create an Expense Report with Falcon Expenses

- What is Included in Falcon Expenses Mileage Log

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Now to the important part …

Deducting Expenses Under an Accountable Plan

Meals and Entertainment

All expense types, travel, meals, and entertainment, are deducted on the company’s tax return if the company reimburses its employees. Typically, only 50% of meals and entertainment expenses can be deducted.** Further, this deduction limit applies even if the company reimburses its employees for 100% of the expense.

Employee Activities

Expenses incurred for providing recreational, social, or similar activities (including the use of a facility) for employees are 100% deductible. The benefit must be primarily to the employees that are not highly compensated.***

Director, Stockholder, or Employee Meetings

Expenses directly related to these meetings are deductible. The main purpose of the meeting must be the company’s business. These expenses are subject to the 50% limit.

Trade Association Meetings

Expenses related to and necessary for attending business meetings or conventions of certain tax-exempt organizations are deductible.

Check Out Falcon Expenses

Falcon Expenses is a fully mobile expense tracking and reporting solution that can help you with your accountable plan. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store. It’s free to try.

How to report these deductions on a tax return are as follows:

- Sole Proprietor (or filling as a single member LLC): deduct travel reimbursements on line 24a and the deductible part of the meals and entertainment reimbursement on line 24b, Schedule C (Form 1040) or line 2, Schedule C-EZ (Form 1040).

- Corporation: reimbursements are included on the “Other Deductions” line of Form 1120, U.S. Corporation Income Tax Return.

Deducting Per Diem and Car Allowances (Accountable and Nonaccountable Plans)

Allowances less than the Federal Rate

Deduct allowances less than the federal rate as travel expenses. This includes meals that may be subject to the 50% limit.

Allowances More than the Federal Rate

Employee allowances above the federal rate must be reported as two separate items.

- The allowance amount up to the federal rate is treated as reimbursed under an accountable plan. Travel expenses, including meals that may be subject to the 50% limit, are deducted from the business return.

- The amount that is more than the federal rate is treated as reimbursed under a nonaccountable plan. Travel expenses, including meals that may be subject to the 50% limit, are deducted from the business return.

Check Out Falcon Expenses

Falcon Expenses is a fully mobile expense tracking and reporting solution that can help you with your accountable plan. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store. It’s free to try.

Reporting Requirements for Expenses on Employee W-2’s:

IF the type of reimbursement (or other expense allowance) arrangement is under

| An Accountable Plan with | THEN the employer reports on Form W-2 |

| Actual expense reimbursement: Adequate counting made and excess returned. | No amount. |

| Actual expense reimbursement: Adequate accounting and return of excess are both required by excess not returned. | The excess amount as wages in box 1. |

| Per diem or mileage allowance up to the federal rate: Adequate accounting made and excess returned. | No amount. |

| Per diem or mileage allowance up to the rederal rate: Adequate accounting made up to the federal rate only and excess not returned. | The excess amount as wages in box 1. The amount up to the federal rate is reported only in box 12 (code L)–it is not reported in box 1. |

| A Nonaccountable Plan with: Either adequate accounting or return of excess (or both) is not required by the plan. | The entire amount as wages in box 1. |

| No reimbursement plan. | The entire amount as wages in box 1. |

You can find this table on the IRS website, here.

Check Out Falcon Expenses

Falcon Expenses is a fully mobile expense tracking and reporting solution that can help you with your accountable plan. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store. It’s free to try.

Nonaccountable Plans

What is a nonaccountable plan?

A nonaccountable plan is when a business provides employees with an allowance for business expenses or travel that does not need to be justified to the employer. This means that the employee does not need to create and submit expense reports to their employer. This money is considered taxable income and should be included on the employee’s W2.

Nonaccountable Plan Overview

All amounts paid, or treated as paid, under a nonaccountable plan are reported as wages on Form W-2. The payments are subject to income tax withholding, social security, Medicare, and federal unemployment taxes. You can deduct the reimbursement as compensation or wages only to the extent it meets the deductibility tests for employees’ pay in chapter 2. Deduct the allowable amount as compensation or wages on the appropriate line of your income tax return, as provided in its instructions.

* Any unsubstantiated expenses reimbursed under these arrangements cannot be treated as reimbursed under an accountable plan. Instead, treat the reimbursed expenses as paid under a nonaccountable plan. In addition, this same rule applies to any excess reimbursement that is not returned within a reasonable period of time,

** Meals and Entertainment expenses also include related expenses such as taxes, tips, admissions (to, say, a nightclub). In addition to rent, to hold a dinner or cocktail party.

The 50% limit does not apply to either of the following:

- Expenses for meals or entertainment treated as:

- Compensation to an employee who was the recipient of the meals or entertainment.

- Wages subject to withholding of federal income tax.

- Expenses of meals or entertainment if:

- A recipient of the meals or entertainment who is not your employee has to include the expenses in gross income. Further, this income must be as compensation for services or as a prize or award.

- The company includes

th is amount on a Form 1099 issued to the recipient if a Form 1099 is required.

*** A highly compensated employee meets the following requirements:

- Owned a 10% or more interest in the business during the year or the proceeding year.

- Received more than $115,000 in pay for the preceding year. The company can choose to only include employees that were in the top 20% of employees when ranked by pay for the preceding year.

Source: IRS Publication 535, Ch 11, Other Expenses, Reimbursement of Travel, Meals, and Entertainment

How can I easily meet these expense reporting requirements?

Download Falcon Expenses

It’s free. And check out if it will work for your company. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data to email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com