How to use Falcon’s mileage expense tracker feature, ‘Addresses’

Table of Contents

Did you forget to log the miles from your last trip? We have a solution.

This article is about Falcon Expenses mileage expense tracker feature called, ‘Addresses’.

Addresses is a convenient feature that allows you to quickly calculate mileage expenses using your trip start and end addresses. Read to learn more.

This means is if you forgot to log a drive or your auto GPS tracker missed a drive, you can quickly calculate the expense with only your departure location and end location.

In this article, we show you how Falcon’s mileage tracker feature, ‘Addresses’, logs everything required by the IRS. Such as date, amount, distance, destination, purpose, etc.

Falcon Expenses is an expense tracker and mileage tracker app. Keep track of receipts, mileage, and time. Then, create expense reports and mileage reports the meet IRS recordkeeping requirements. Email these reports to anyone in PDF or spreadsheet formats, all from your phone.

Before we begin, if you’re using the standard mileage rate tax deduction method make sure you use the mileage rate for the appropriate year. For the entire updated rate chart, check out this post: IRS Standard Mileage Rates.

We Feel Your Pain

Driving your personal car for work is frustrating.

Especially if you put a ton of mileage on your car just for your job. You should be reimbursed for it.

This is where a mileage expense tracker app comes in handy.

You’re eligible to deduct more than $6000 dollars in mileage expenses from your tax return if you’re self-employed and drive just 40 miles each workday.

However, to do this you need to keep a mileage log that meets IRS recordkeeping requirements.

With Falcon Expenses, it’s no longer a hassle to keep a mileage log.

For example, don’t worry about unreliable auto GPS mileage trackers to track all your drives, which you must tediously sort through later.

Further, don’t worry about misplacing or damaging a mileage log created from pen and paper.

Forget about the effort required to go to your desktop and enter cumbersomely enter your mileage into an excel spreadsheet.

We know you secretly wish you never had to open that spreadsheet again. This wish is now going to come true. Mileage expense tracking is now easy.

All these problems are solved with the simple and easy-to-use Falcon Expenses Addresses feature for mileage expense tracking.

Falcon Expenses remembers the addresses you enter so that the next time you go to calculate mileage expenses it is even faster. Thus, mileage expense tracking has never been easier.

What are the Benefits of Falcon’s Addresses Feature?

Remembers Your Addresses

Once you enter an address into Falcon Expenses, it saves that address. Therefore, you can use your saved address next time you make a business trip or commute that starts or ends at the same address. As a result, entering mileage expenses becomes faster and more efficient each time. This mileage expense tracking feature is particularly convenient if you frequently depart from the same location or travel to the same location.

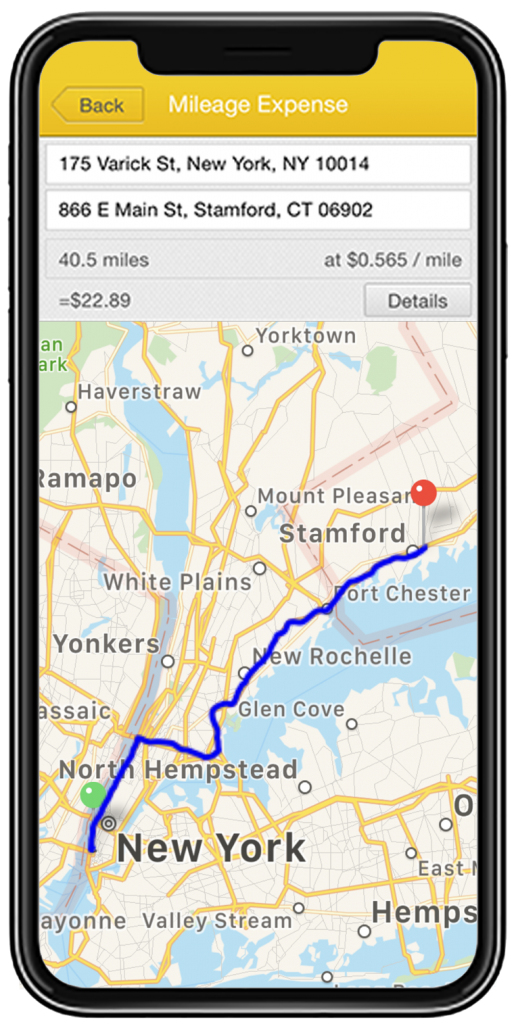

Measures Driving Distance

After you enter a start and end address, Falcon calculates the driving distance between the two addresses. It’s important to note that Falcon calculates the driving distance, versus calculating a straight line between the two addresses. This is because a driving route often has curves and turns. Therefore, it is not a straight line, and a straight line would calculate an inaccurate, shorter distance.

Calculates Mileage Expense Amount

The amount of your mileage expense is automatically calculated for you, leaving yet one less step for you. The expense amount is calculated from the mileage expense reimbursement rate and the distance of the mileage expense. Further, the expense reimbursement rate is set by the user. Set your mileage reimbursement rate to whatever rate you need.

Click Here to Download Falcon Expenses

If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Keeps Mileage Expenses Organized

All of your expenses remain safely organized in your Falcon Expenses app. View them by date, project, client, tag, etc. In addition, sort and filter your expenses however you need to, all from your phone.

Easily Categorize and Organize Mileage Expenses

With Falcon Expenses, assign one category to each saved expense and as many tags as you would like. Use tags to add necessary details to your expenses for proper record keeping. For example, create custom tags based on client names, project, project codes, destinations, and more. Also, add a category such as the type of drive.

For example, personal or business. Or, create a custom tag, even delete a tag that you no longer need. The options are endless.

Lastly, edit the date to the date the expense was incurred using the date editor that is located on each expense entry form. Most importantly, the details you need for the IRS or your manager, or whoever, will be there.

Use Falcon On-The-Go

Falcon Expenses resides on your phone, after all, it is an app. With that said,

Click Here to Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

How to Use Falcon Expenses Addresses Feature

- Open Falcon Expenses, select ‘Track Mileage Expenses’, then select ‘Addresses’.

- Enter your start and end addresses, or select them from the list of remembered addresses. You can also enter only the start address and enter the end address later. This is great if you want to enter the end address at the end of a trip.

- Tap ‘Details’, and enter the reason for your trip in the comment field, add a category, and/or custom tags. Select a report (or not).

- Tap ‘Save’, located in the upper right. That’s it!

Click Here to Download Falcon Expenses

If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

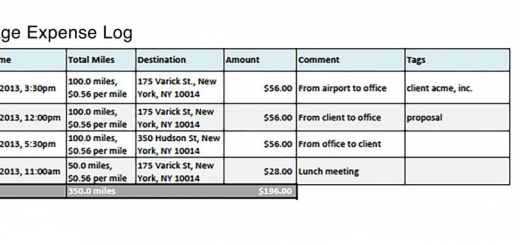

How do I create a mileage log?

After you’ve entered all your mileage expenses you can create a mileage report. Email this report to anyone from your phone.

For example, create a report to give to your boss or your employer after a business trip.

Or to provide a monthly (or annual) mileage log to your accountant.

Or just for your personal recordkeeping.

Essentially, you can create a mileage expense report for any of your needs.

Export mileage reports in PDF or spreadsheet formats.

Report exports include the data that you entered and that was calculated by Falcon when you created the mileage expenses. This includes the start and end addresses, number of miles, amount of mileage expense, tolls and parking, comments, tags, categories, etc. It is all there! You can export all of this data by email, to anyone.

Review the following article about how to create a mileage report: How to Create a Mileage Report with Falcon Expenses.

Email reports to anyone from your phone. This post will cover how you can do that. Don’t forget to check out Falcon Expenses today, we promise you won’t be disappointed.

Click Here to Download Falcon Expenses

If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data for email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.