What is an IRS Schedule C Form? What is 1040 Schedule C? (Everything You Need to Know, Updated for 2021 Tax Year)

Table of Contents

If you’re self employed or a single member LLC then you likely need an IRS Schedule C Form. Or, wondering what is 1040 Schedule C. Read on to learn where to get a Schedule C, and how to use it.

Are you wondering, what is an IRS Schedule C form? Keep reading this article to find out.

Who needs to file a Schedule C?

Are you asking yourself, do I need to file a Schedule C?

Self-employed individuals, sole proprietors, and those operating a single-member LLC report profit and loss from their business on a Schedule C tax form. A Schedule C form is attached to the standard 1040 tax form. This is why some people call the form a 1040 Schedule C, and they ask, what is 1040 Schedule C?

Are you a self-employed sole proprietor with a growing business and considering forming a single-member LLC?

Check out this article if you answered, yes, Sole Proprietor vs Single-Member LLC: The Complete Comparison.

Many small business owners, such as sole proprietors, have a small business bank account. There are many benefits of having a business account. However, you don’t necessarily need to be incorporated to have a business checking account. Therefore, independent contractors, gig workers, delivery drivers, etc, that aren’t incorporated, yet have business bank accounts need to file a Schedule C.

What is a sole proprietor?

According to the US Small Business Administration, a sole proprietor is the simplest and most common business structure. It is defined as an unincorporated business owned and run by one individual with no distinction between the business and the individual.

What is a Schedule C tax form?

An IRS Schedule C (sometimes called a 1040 Schedule C) is a form used to report income or loss from a business operated by a sole proprietor or a single-member LLC. On this form, entrepreneurs report their income, expenses, profits, and losses for their business activities for a given year. Also, entrepreneurs that own and operate more than one business need to file a separate Schedule C form for each business.

What qualifies as a business activity for a Schedule C form?

For an activity to qualify as a business, the individual must be engaged in the activity for income or profit and be involved in that activity with continuity and regularity. For example, sporadic activity, or hobby, does not qualify as a business. To report income from a nonbusiness activity, see the instructions for Schedule 1 on Form 1040 or 1040-SR, line 8, or Form 1040-NR, line 21.

Falcon Pro Tip

We recommend that all self-employed, sole proprietors and single-member LLC business owners have a business checking account. There are many benefits of having a business checking account. Keeping your business and personal finances is an important step for anyone that takes the business seriously.

Read this article for a simple guide about how to open a business bank account (if you have not already), How to Open a Business Bank Account: A Simple Guide.

What is Schedule C income?

Schedule C income is any income (or loss) earned by an individual who worked as a sole proprietor or as a member of a single-member LLC.

In addition, when using an IRS Schedule C form the individual may be subject to state and local taxes and other requirements such as business licenses and fees. Therefore, check with local states and governments to find out more information.

Complete a Schedule C and attach it to your 1040 personal tax return if you received profits or losses from self-employed work that was completed as an individual and not under a formal, separate, entity (unless it is a single-member LLC).

If you’re self-employed or a sole proprietor and want to take advantage of the many self-employment tax deductions you need a reliable expense tracker such as Falcon Expenses. Falcon Expenses is a mobile expense and mileage expense tracker app. It is free to download. Check it out today.

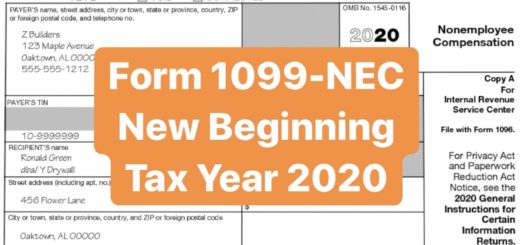

How is a Schedule C different from a 1099-MISC (and a 1099-NEC)

A 1099-MISC form (in 2020 a 1099-NEC) is the form provided to individuals that worked as a freelancer or contractors for another company. An independent contractor that performed the work as an individual and not under a registered, formal, entity (other than a single-member LLC) would be recognized as a sole proprietor. Therefore, they are required to file a Schedule C form. With that said, the 1099-MISC and 1099-NEC forms received by this individual should be included in your Schedule C, along with any other business income an individual receives.

Important Note:

Starting with the 2020 tax year a new form for miscellaneous income will be used. This form is known as 1099-NEC. With the growth of self-employment, the IRS felt that a dedicated form for self-employment income was necessary. Therefore, the 1099-MISC will be reserved for income earned from rent, royalties, prizes, awards, and substitute payments in lieu of dividends. The new 1099-NEC, which is a form resurrected from the 1980s, is for only non-employee compensation.

Review the following article for more information on this new form:

Form 1099-MISC vs Form 1099-NEC: How are they Different?

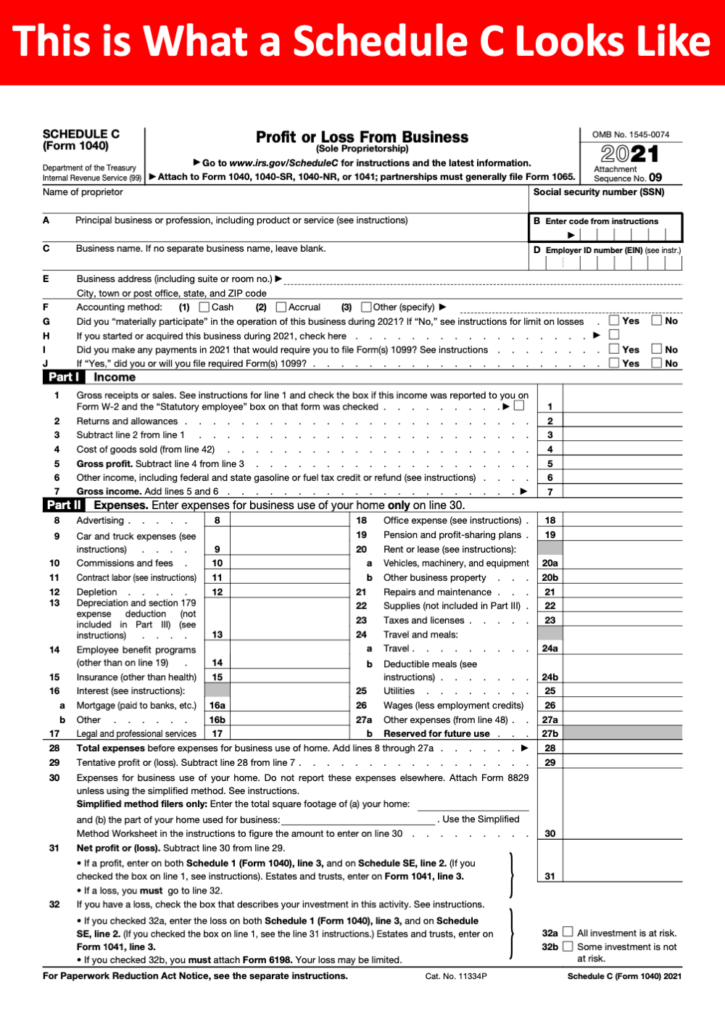

What does an IRS Schedule C form look like?

How to complete a Schedule C form (IRS Schedule C instructions)?

Submit your email and we'll send you an IRS Schedule C for the 2021 tax year, along with the IRS instructions.

Read below for instructions on how to fill out an IRS Schedule C form.

There are six major sections of an IRS Schedule C form. Below, each section is organized and explained. Click the link about the Schedule C instructions for instructions about how to fill out the IRS Schedule C form.

1. Top Quarter, Background Information

This section is for filling in the basic information about your business. Such as business name, address, EIN, etc.

Do you have to have an EIN number to file a Schedule C?

Only corporations and partnerships are required to have an EIN number. Therefore, if you are a sole proprietor then you can use your Social Security Number to report your income on an IRS Schedule C tax form. However, if you have a sole proprietorship operating as a single-member LLC then you would need an EIN number. Refer to the following article for more information about EIN numbers, Do I Need an EIN Number and How to Get One?

Line A: Describe the business or professional activity that provided the income reported on line 1.

Line B: Enter the six-digit code from the Principal Business or Professional Activity Codes chart, located at the end of the Schedule C instructions document published by the IRS.

Line C: Business name. Leave this field blank if no separate business name exists.

Line D: Employer ID number (EIN). Check out the following article if you don’t have an EIN number, and you don’t know what an EIN number is to learn more.

How do I get an Employer Identification Number (EIN)?

Line F: Select the box for the accounting method used: Cash, Accrual, Other (specify).

Line I: Did you make any payments that would require you to file Form(s) 1000?

Line J: If ‘Yes,’ did you or will you file the required Forms 1099?

2. Part I, Income

What is business income?

Gross income includes income from whatever source derived. However, in some cases, gross income does not include extraterritorial income that is qualifying foreign trade income. Use IRS Form 8873 to determine the extraterritorial income exclusion.

In this section enter gross receipts or sales. In addition, enter costs of goods sold and calculate gross profit. There is also a line for other income. Add this to gross profit to get the gross income amount, which is the final amount for this section.

3. Part II, Expenses

In this section enter business expenses. Business expenses include everything from advertising, car and truck expenses, commissions and fees, contract labor, rent, office expenses, supplies, repairs, etc. In some cases, you can even deduct clothing expenses. Also, don’t forget to write off your tax preparation fees.

Check out the following article for more information on business expenses: IRS Rules for Recording Business Expenses, Travel, Transportation, Meals, and Entertainment.

4. Part III, Cost of Goods Sold

What are cost of goods sold?

According to Investopedia, Cost of Goods Sold (COGS) are the direct costs of producing the goods sold by a company. This includes the costs of materials and labor directly used in the creation of the good. This does not include indirect expenses. Examples of indirect expenses include distribution costs and sales force costs.

5. Part IV, Information on Your Vehicle

This part is only completed only for individuals that are claiming car or truck expenses on line 9 from Part II, Expenses. In addition, individuals required to fill out IRS Form 4562 are not required to fill out this section.

The following post provides an informative overview about business use vehicle tax deductions and the different tax deductions methods available:

How To Maximize Business Use Car Tax Deductions (Standard Mileage Rate vs Actual Car Expense Methods)

Also, this post about commuting is informative for this section:

Temporary Work Locations & Commuting Expenses Tax Deductions

6. Part V, Other Expenses

In this section, other business expenses are listed that are not included on lines 8-26 or line 30.

About Falcon Expenses

Falcon Expenses is a top-rated mobile application for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss out on.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily prepare expense reports to email to anyone in PDF or spreadsheet formats, all from your phone. Use for keeping track of tax deductions, reimbursements, taxes, odometer logs, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.