How to track mileage with a GPS mileage tracker app

Table of Contents

Deduct $4000+ in mileage expenses from your taxes if you drive just 30 miles each workday. Learn to use a GPS mileage tracker app.

Read on to learn more.

How to Track Mileage Intro

To take a mileage tax deduction for business miles driven with your car, you need to keep an adequate mileage log. This is particularly important for self-employed individuals.

What are IRS Requirements for Mileage Deductions

The IRS does not require you to log odometer readings for each drive. The minimum odometer readings you need to log are the start and end readings from the beginning and end of the year. The tax law doesn’t specify that you need to keep odometer readings for each drive. All you need to keep is an adequate record of the distance you drove.

The IRS requires that you record four facts when you drive your car for business:

- time and date of drive

- distance of drive

- destination

- and the business purpose

You can find all of the details about these requirements on the IRS website in the following publication:

IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, Table 5-1

How to Track Mileage

The easiest way to track mileage for work is with a tax mileage tracker app. For example, with a simple car mileage tracker for business like Falcon Expenses, your mileage is automatically tracked as you drive. Falcon runs in the background and tracks your miles as you drive. This way you never miss a tax-deductible mile.

Before the year 2000, the technology was not available for accurate GPS tracking to create a car mileage tracker for business. With that said, applications like Google Maps and Falcon Expenses could not be paired with the GPS on your phone to create a tax mileage tracker.

How to Use Falcon’s GPS Mileage Tracker App

Welcome! If you haven’t already downloaded Falcon Expenses mileage tracker for taxes, please do so. This will help you to complete the steps below.

Download Falcon Expenses

Falcon Expenses is free to download. If you’re on a desktop it’s best to use your iPhone and search for Falcon Expenses on the app store.

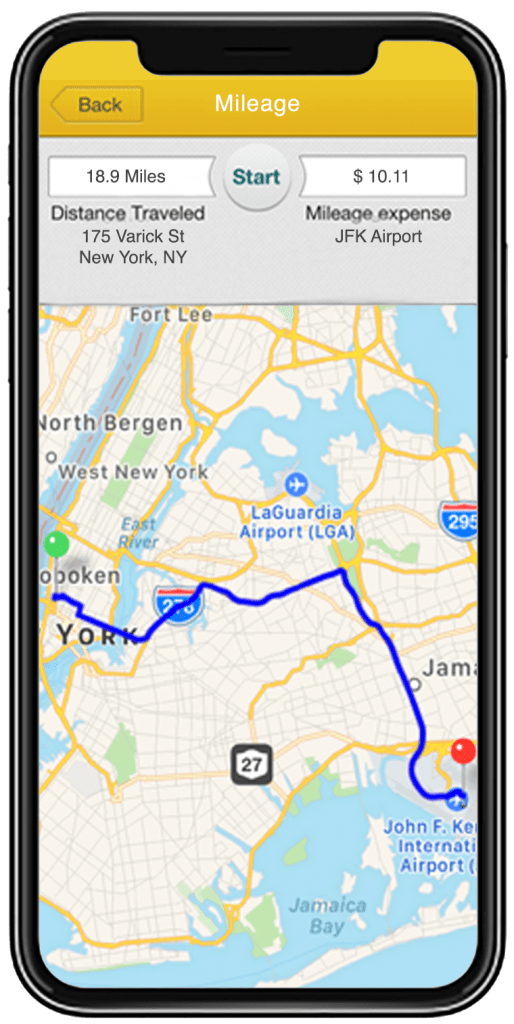

- First, open Falcon Expenses, select ‘Track Mileage Expenses’, then select ‘GPS’.

- Then, tap the ‘Start’ button when you are ready to begin your business drive.

- Next, tap ‘Stop’ when you’re finished with your business drive. Automatically your mileage expense amount is calculated using the mileage reimbursement rate you set from the settings page.

- Enter a reason for your trip in the comment field. add a category, and/or custom tags. Select a report (or not).

- Tap ‘Save;, located in the upper right. That’s it!

Falcon’s GPS Car Mileage Tracker App Benefits

Uses the GPS in Your Phone

Falcon Expenses accurately tracks your business mileage by using the GPS that is already built into your phone. Further, miles are automatically tracked as you drive; never lose a dime on a business mileage expense deduction again. Falcon is a reliable mileage tracker app for taxes.

Measures Driving Distance

After you start and stop your trip, Falcon knows how many miles you traveled based on the GPS tracker data. Further, from this data Falcon calculates the driving distance.

Calculates Mileage Expenses Amount

The Falcon mileage tracker for business automatically calculates your mileage expense amount.

This saves you time.

Expense amounts are calculated from the mileage expense reimbursement rate and the distance of the mileage expense. Further, set your own mileage reimbursement rate. Therefore, you can set your mileage reimbursement rate to whatever you would like.

Organizes Mileage Expenses Organized

All your expenses remain safely organized in your Falcon Expenses mileage tracker for business. View them by date, project, client, tag, etc. In addition, sort and filter your expenses however you need to, all from your phone.

Categorize & Organize Mileage Expenses

With Falcon Expenses, assign one category to each saved expense and as many tags as you would like. Also, use tags to add necessary details to your expenses for proper record keeping. For example, create custom tags based on client names, projects, project codes, destinations, and more. Also, add a category such as the type of drive. For example, personal or business. Or, create a custom tag, even delete a tag that you no longer need. The options are endless. Most importantly, the details you need for the IRS or your manager, or whoever, will be there.

Here are some guides about how to create custom tags and categories:

How do I create a custom tag?

How do create a custom category?

Pro tip

Use custom tags to easily categorize drives based on your needs. For example, personal versus business, by car, by project; categorize your drives any way you’d like.

You can do the same with custom categories. The point is, Falcon Expenses is super flexible and has all the features and functions to meet your specific needs. Download Falcon today, and check it out for yourself.

Use Falcon On-the-Go

Falcon Expenses resides on your phone, after all, it is a tax mileage tracker app. With that said, add, edit, and manage your mileage expenses from anywhere. Falcon Expenses is fully mobile, this means that you have a full set of expense management features in the palm of your hand.

Self Employment Resources

Many Falcon customers are self-employed. Therefore, below are a number of valuable resources for self-employment.

A Definitive List of Self Employment Tax Deductions

What is Self Employment Tax

Home Office Tax Deductions for Self Employed

What is an IRS Schedule C Form

For details on Falcon’s other features review the following posts:

- How to Scan and Manage Receipts with Falcon Expenses

- How to Track Mileage Expenses with Your Business Trips Addresses

- Falcon Expenses Expense Report Template & What Expense Reports Look Like

- How to Use Falcon Expenses to Keep an Odometer Log of Business Mileage Expenses

- What is Included in Falcon Expenses Mileage Expense Log

About Falcon Expenses

Falcon Expenses is a top-rated car mileage tracker for taxes. It is used by self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait the more tax deductions you miss out on.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily prepare reports for email to anyone in PDF or spreadsheet formats, all from your phone. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, business travelers, truckers, and more.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.