Can you write off clothes for work? The complete guide.

Table of Contents

Wondering if you can write off the suit or uniform you just bought? Read this article to answer, can you write off clothes for work? We also show you how to do it.

Who can write off work clothes?

Are you wondering, if I’m an employee can I write clothing?

Or more specifically, if I’m a W2 employee can I write off clothing?

(i.e. I’m on the payroll and receive a regular paycheck.)

Self employed clothing write off

Self-employed workers can write off clothing expenses, just as employees can. To learn more about how to write off clothing expenses as a self-employed individual scroll down towards the bottom of this post and read the section, How to write off clothes for work.

Related: The Complete List of Small Busines and Self Employment Tax Write Offs

Rules for Writing Off Work Clothes

1. You wear it for work

Work clothes are tax-deductible if you are required to wear them every day for work. The most common thing that comes to mind when you hear, ‘required to wear for work’, is uniforms. Uniforms you only wear for work, and you typically don’t wear them outside of work.

Now you might be asking, what about suits?

Can I write off the cost of my suits from my taxes?

I wear my business suits every day for work, but also I sometimes wear my work suits outside of the office.

The answer to this question brings us to point number two.

2. You only wear it for work

For the cost of work clothes to be a tax-deductible business expense, you must only wear the clothing items to work–and nowhere else. This means that if you own a suit, which you wear to work every day, but sometimes you wear it outside of work–it is not tax-deductible.

Work clothes that aren’t deductible

What clothes can I write off?

As we mentioned above in the section, Rules for Writing Off Work Clothes, the clothes you can write off for work must be worn every day for work, and only for work.

The IRS made this rule a bit tricky, intentionally. The intention was so that you don’t go on a shopping spree and buy a bunch of clothes for work thinking, hey this dress will also look great for that dinner out with friends, and I can deduct it from my taxes.

But what clothes can you write off?

The best test to determine if your clothes are tax-deductible is to ask yourself if you would get weird looks if you wore the attire outside of work. Meaning, your suit probably won’t get your weird looks even if you only wear it for work, and wear it every day. However, the IRS doesn’t consider it a tax deduction as you can and probably will at some point wear it outside of work as ordinary clothing. To your friend’s wedding, maybe?

Safety items and uniforms are clothing tax write-offs.

For example:

- Medical scrubs

- Hard hats

- Safety boots or shoes

- Work gloves

- Safety glasses

Some professions that should be able to deduct safety clothing from their taxes are:

- Electricians

- Carpenters

- Electricians

- Cement workers

- Machinists

- Chemical workers

How much can you write off for work clothes?

Work clothes are a miscellaneous tax deduction. Your total write-off for clothing is up to 2% of your adjusted gross income (AGI). This means the amount you spent on work clothing that exceeds 2 percent of your adjusted gross income is not tax-deductible.

Adjusted Gross Income

Also known as AGI, is your gross income minus adjustments to income.

Gross income includes your wages, business income, capital gains, dividends, retirement distributions, and other income.

Income adjustment includes student loan interest, alimony payments, educator expenses, or contributions to retirement accounts.

Writing off clothes as a promotional expense

Can I deduct my work clothes?

A deduction is the same as a tax write-off, so the same rules and qualifications apply for clothes that you can write off.

Can I deduct laundry expenses?

Yes, laundry expenses are tax-deductible!

The cost of laundry and other clothing upkeep is a tax write-off if your clothes qualify as a tax-deductible business expense. Please check out the sections named, Rules for Writing off Clothing, to determine if your clothes qualify.

Can I write off my dry cleaning?

Yes, dry cleaning expenses are tax-deductible!

The cost of dry cleaning and other clothing upkeep is a tax write-off if your clothes qualify as a tax-deductible business expense. Please check out the sections named, Rules for Writing off Clothing, to determine if your clothing qualifies.

Can you write off military uniforms on taxes?

The cost of any uniforms, including military uniforms, that you purchase that you won’t wear off duty are tax-deductible. All of your uniform cleaning and maintenance is a tax deduction as well.

How to write off clothes for work?

How to write off clothes if you’re a W2 employee

A work clothes tax write-off falls under a miscellaneous tax deduction. Miscellaneous tax deductions are for miscellaneous expenses. Miscellaneous expenses need to be itemized.

For W2 employees, a miscellaneous tax deduction is filed with your 1040 tax return by attaching a Schedule A tax form.

Individual taxpayers that decide not to take the standard deduction, and instead want to itemize their expenses, use an IRS Schedule A form to itemize their tax write-offs.

What is a miscellaneous tax deduction?

Miscellaneous tax deductions are tax write-offs that don’t fit on another tax deduction category. For example, some employees are allowed to deduct work expenses such as work uniforms, advertising costs, accounting, and legal fees, as a miscellaneous deduction.

How to write off clothes if you’re self-employed

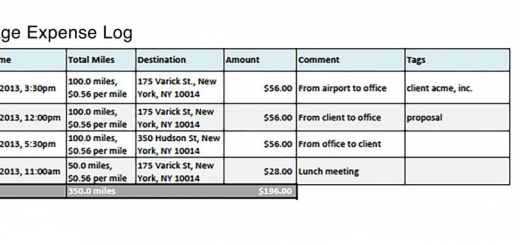

For self-employed taxpayers, clothing deductions are accounted for on their Schedule C.

Self-employed taxpayers include freelancers, independent contractors, 1099 workers, delivery drivers, etc.

Conclusion

There are many write-offs available to taxpayers. Clothing is one of them. However, it’s important to make sure the clothing expenses you deduct from your taxes meet the IRS requirements for a clothing tax deduction. That is why it’s important to review the contents of this article and to make sure your clothing write-offs are for work clothes you wear every day, and only for work.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com