Form 1099-MISC vs Form 1099-NEC: How are they Different?

Table of Contents

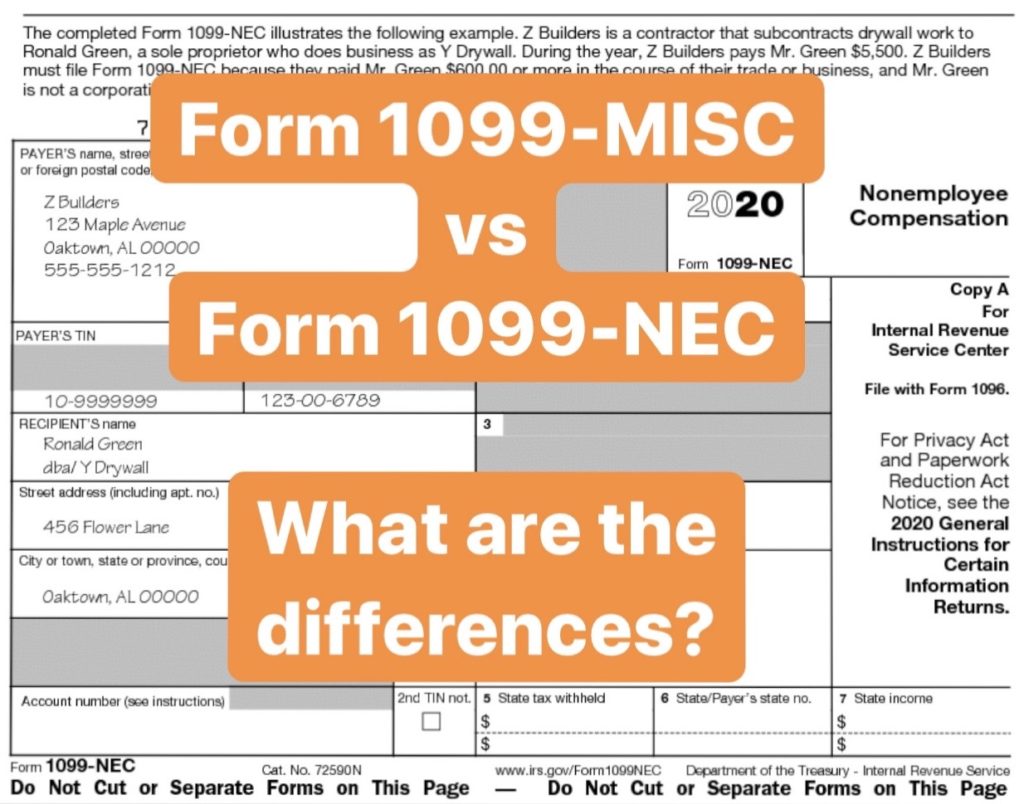

This article explains the difference between Forms 1099-MISC and 1099-NEC. Form 1099-NEC is a new tax document starting in the 2020 tax year for nonemployee compensation.

Note: Download links to both forms, including their instructions, are at the bottom of this article.

Check out the following article to make you’re taking advantage of all self-employed tax deductions available to you, A Definitive List of Self Employment Tax Deductions (Some Might Surprise You).

Form 1099-MISC

Form 1099-MISC reports the total amount of payments a person receives from a single person or company during the tax year. The IRS requires any person or business to report certain types of payments on a 1099-MISC Form and to the IRS. The type of payments the IRS requires to be reported on this form are:

- Rent

- Royalties

- Prizes

- Awards and substitute payments in lieu of dividends

Form 1099-MISC used to be most commonly used for reporting earnings of independent contractors and consultants, both types of employment where the person employed is not an employee of the company. This is also known as nonemployee compensation. Starting in the 2020 tax year all non-employee compensation will be reported on a new form, Form 1099-NEC.

Form 1099-NEC

Form 1099-NEC is a form dedicated to only non-employee compensation, also known as self-employment income. This is the income that is received when someone is employed by an employer as an independent contractor versus an employee. Basically, Form 1099-NEC is an entire form dedicated to Box 7 on Form 1099-MISC. Subsequently, for the tax year 2020, Box 7 has been removed from Form 1099-MISC. Essentially, Form 1099-NEC serves a similar purpose as Form W-2 does for employees. That purpose is to report the total amount of payments a person receives from a single person or business during the tax year.

Please note Form 1099-NEC was released mid-2019 and will be in use beginning with the 2020 tax year. That means, not until the beginning of 2021, after the end of the 2020 tax year, will people receive their 1099-NEC Form.

Why did the IRS create Form 1099-NEC?

There are two main reasons why it made sense for the IRS to designate a form specifically for nonemployee compensation.

- More and more people are working as independent contractors making it make more sense to have a tax form dedicated specifically to this income.

- Previously, when nonemployee compensation was reported on Form 1099-MISC, it had a different deadline date than the form itself. Therefore, it didn’t make sense to use one form for payments that have two different deadline dates with the IRS.

What does the IRS define as self-employment income?

Nonemployee compensation is compensation earned by an individual that works as an independent contractor or is self-employed. Essentially, nonemployee compensation is compensation earned from a company where the individual compensated is not on the payroll. However, for the purpose of reporting nonemployee compensation on Form 1099-NEC, it is a bit more specific than that. According to the IRS, payment must be reported if all of four of the following conditions are met.

- The compensation is made to someone who isn’t an employee

- The compensation is made for services done in the course of trade or business

- The compensation is made to a partnership, individual, estate, or, in some cases, a corporation

- The compensation made to the payee is $600 or more for the year

Download the most recent (new for 2020 tax year) form 1099-NEC, here

Instructions for form 1099-NEC are, here

Download the most recent form 1099-MISC, here

Instructions for form 1099-MISC are, here

You could be missing out on self-employment tax deductions. This means you’re taking home less income than you should. Check out our detailed list, along with descriptions about how to qualify for each one, of all self-employment tax deductions, here. Make sure that you’re taking advantage of each one that you qualify for.

About Falcon Expenses

Falcon Expenses is a mobile expense tracker and mileage tracker app. Scan receipts, we type merchant, date, and amount, auto-track mileage expenses via GPS, and log billable hours with an integrated timer. Quickly organize expenses by time period, project, or client and easily prepare reports to email to anyone in PDF or spreadsheet formats, all from your phone. Use for reimbursements, taxes, record-keeping, or invoicing. Falcon Expenses is great for professionals, freelancers, realtors, business travelers, truckers, and more.

Please check out the following articles for more information about Falcon Expenses features and services:

- How to Scan and Manage Receipts with Falcon Expenses

- How to Track Mileage Expenses with Falcon Expenses

- Falcon Expenses Expense Report Template & What Expense Reports Look Like

- What is Included in Falcon Expenses Mileage Expense Log

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com