The Best Expense Report Template in Excel

Table of Contents

Do you need an expense report template in Excel? In this article is a downloadable expense report template for Excel that meets IRS recordkeeping requirments.

Table of Contents

- Why should I use an expense report template?

- What to look for in an expense report template

- What to look for in an expense report template for miles

- Advantages of an expense report template

- Take your template to the next level

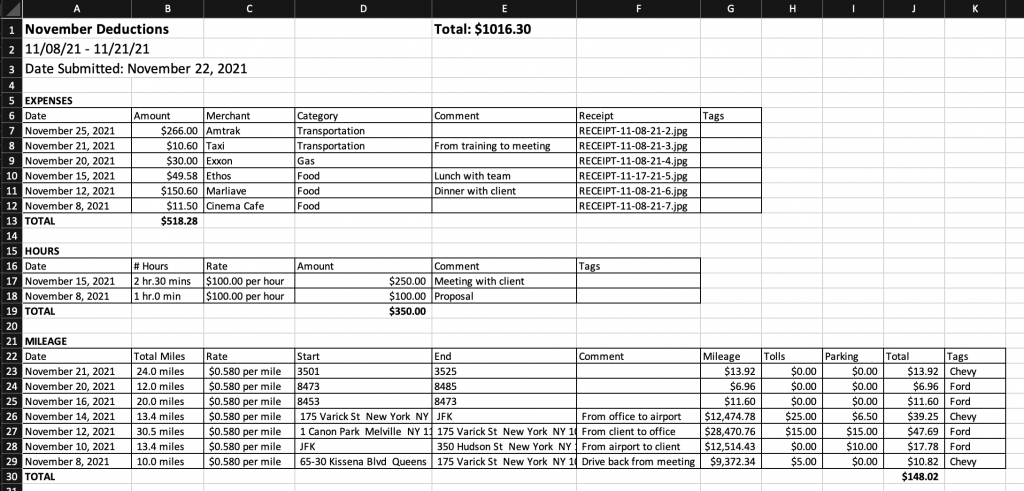

- What does our expense report template look like?

- Free expense report template download

Do you need an expense report template for small business to organize and calculate your expenses?

Or, are you self-employed and need an expense report template in Excel?

Do you need an expense report template for Google Sheets?

Do you need a handy way to log business trips and automatically calculate your mileage expenses?

Read this article to learn about our free expense report template for small businesses and self-employed.

Scroll to the bottom for a free download of our expense report template.

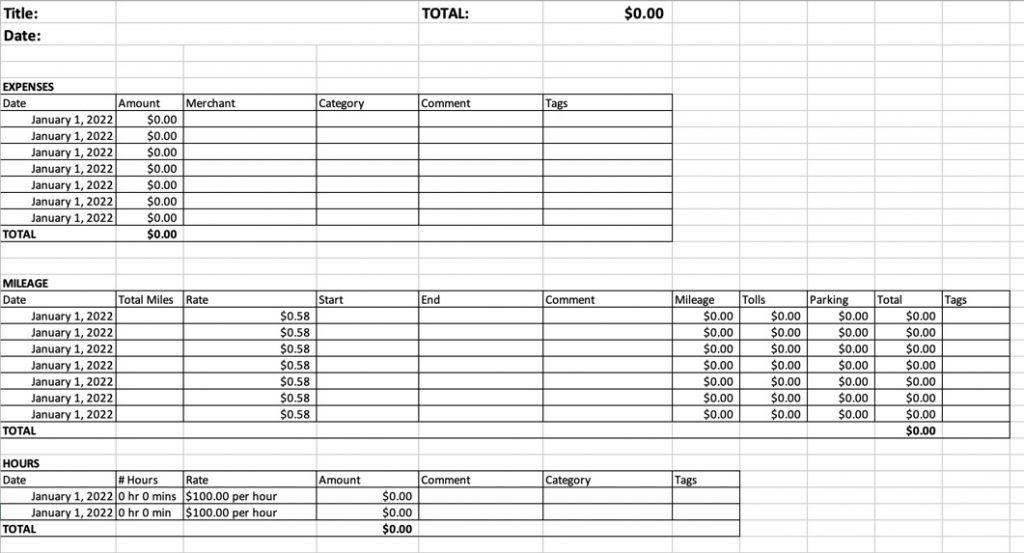

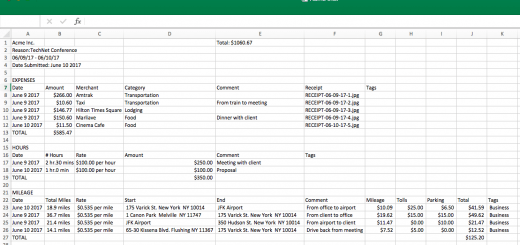

Our free expense report template contains all the fields you need in an easy-to-use and easy-to-read format. Also, it meets IRS requirements for expense record keeping.

Also, each expense report template is programmed to automatically calculate your expenses, this includes tedious mileage expense calculations. So, if you’re not savvy with Google Sheets or Excel, we’ve got you covered!

Running a business is already a daunting task. Whether you’re a sole proprietor or manage a small team, it’s always a tedious task to keep a record of business expenses. Also, it’s often even more daunting to know IRS expense recordkeeping requirements. As a self-employed individual or small business owner, you want to take advantage of every business and self-employment tax deduction. In addition, you want to keep an IRS-compliant record of your self-employment and business expenses. This is why it’s important to have a good expense report template in Excel (or Google Sheets, whichever you prefer).

Why should I use an expense report template in Excel?

An expense report template allows you to organize all your expenses in one place. It helps you to not lose or forget any tax deductions and thus maximizes your take-home income. All while saving you time and money.

What to look for in an expense report template for Excel

An expense report template for small businesses or self-employed should meet IRS expense record keeping requirements. Our expense report template contains all fields and sections that meet IRS record-keeping requirements.

What to look for in an expense report template for miles

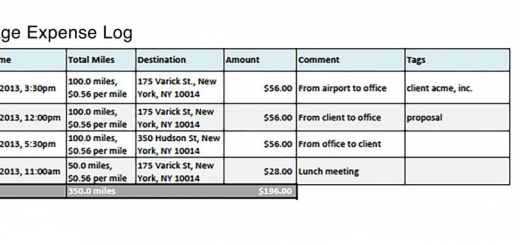

Many self-employed individuals and small business owners drive for work and use their personal cars. Often miles driven for work are tax-deductible. Therefore, you need a reliable way to log your deductible mileage if you drive for work.

With that said, there are some key things to look for in an expense report template in Excel to properly log your tax-deductible mileage. For starters, you might want to keep a log for each vehicle you have. Especially if you use more than one vehicle. Therefore, you need a way to designate what vehicle was used for each mileage log. For example, a column in the expense report template where you add the vehicle. Some other specific things to look for in a miles expense report template are:

- A vehicle column or field for tracking the vehicle used for the business trip. This could come in the form of category or tag, or a column dedicated specifically to vehicles.

- The ability to log start and end odometer readings, or start and end addresses.

- A mileage rate column to add the per mileage rate for your drives.

Advantages of an expense report template in Excel (or Google Sheets)

An adequate expense report template for small businesses and self-employed in Excel saves you time by providing insight into your spending. It helps you gain a quick snapshot into your send by auto-calculating and visually organizing your spending based on category and expense type.

Take your template to the next level with automated tracking

Going to a desktop and manually typing your expense data into an expense report template for small businesses is tedious. Also, often doing this is after the fact. Meaning, there is a delay between when you incur the expense and when you log it. So you could forget about the expense and its details altogether.

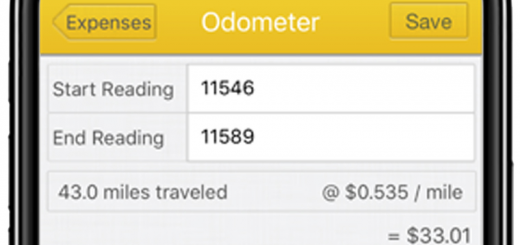

Further, this is more complicated for mileage expenses. To log mileage expenses people often keep a paper log in their car and write them down for each drive. Or they don’t log them at all and guess, hoping the IRS won’t audit them.

There is a better way to do all of this. That is by using an automated expense tracker and mileage tracker app like Falcon Expenses. Never miss or miss-calculate a deductible mileage expense again with an expense tracker and mileage tracker app like Falcon Expenses. Falcon Expenses automatically tracks your miles as you drive.

Did you know, expense report template data entry can be automated?

Let us explain.

For example, say you need to keep a mileage log of mileage expenses. Falcon Expenses automatically tracks your drives with a GPS tracker instead of you manually recording start and end addresses or odometer readings. However, there is also an option to keep an odometer log.

In addition, use Falcon Expenses to snap pictures of paper receipts and safely save them as you acquire them. Add the receipt data at that moment, or at a later time.

What does our expense report template for Excel look like?

Free expense report template download in Excel

Enter your email and we'll send you the best expense report template in excel.

About Falcon Expenses

Falcon Expenses is an expense tracker and mileage tracker app. Falcon customers record over $6,600, on average, in annual tax deductions. Get started today. The longer you wait the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client and easily prepare reports to email to anyone in PDF or spreadsheet formats, all from your phone. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, business travelers, truckers, and more.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.