What is IRS Business Travel Definition for “Away From Home”?

Table of Contents

This article provides the IRS definition of business travel and what qualifies as IRS business travel for tax write offs.

Many self-employed individuals and small business owners travel for work. Yet, they are confused about what business travel is considered a tax-deductible business expense. In this article, we outline in simple English the IRS definition of business travel based on information provided by the IRS (at IRS.gov). Therefore, the information is easier to consume than reading through dense IRS jargon. All sources are provided for your reference.

IRS Definition of Business Travel

The IRS definition of business travel is travel for business that is, ‘away from home’ for a duration longer than an ordinary day’s worth of work. According to the IRS, ‘away from home’ means outside of the entire city or general area outside of the location of the main place of business. Also, durations longer than a day’s work typically mean an overnight stay.

Therefore, the IRS definition of business travel has two main components.

- The business travel must be ‘away from home’.

- The business travel must be for a duration of an ordinary day’s worth of work.

Are transportation expenses business travel expenses?

Employees or self-employed individuals incur transportation expenses while traveling for business. Transportation expenses include expenses from taking the bus, train, or plane, etc.

Are commuting expenses business travel expenses?

We highly recommend you read this article if your business travel or drives are potentially on the border of what is considered business travel versus commuting:

How Does the IRS Define Commuting?

Examples of Business Travel

If your office is in Sacramento and you travel for business to San Francisco for a business meeting where you stay at a hotel for one night, your expenses from this trip are deductible as business travel expenses. The deductible expenses would include the cost of your mileage, meals, entertainment, etc. However, if you travel for work within Sacramento and rent a hotel for one night, these expenses wouldn’t be deductible. This is because you didn’t leave your tax home. If the taxpayer regularly works in more than one area, their tax home is the area where the main place of business is located. This main place of business will likely be where the taxpayer spends the most amount of time. For more information on this tax topic, see IRS Tax Topics, Topic 511-Business Travel Expenses.

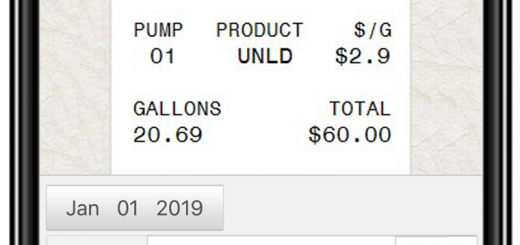

Check out Falcon Expenses if you’re a small business owner and need a simple way to automatically track and organize business expenses. Falcon customers record $6,600, on average, in annual tax deductions including those for business travel. Start today.

Track Expenses with an Expense Tracker App

- How Manage Receipts with Falcon Expenses

- How to Track Mileage Expenses with Falcon Expenses

- Falcon Expenses Expense Report Template & What Expense Reports Look Like

- How to Create an Expense Report with Falcon Expenses

- What is Included in Falcon Expenses Mileage Expense Log

Download Falcon Expenses, Free

The longer you wait the more tax deductions and reimbursements you miss. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Learn more about the IRS rules for recording business expenses by reading this post, IRS Rules for Recording Business Expenses: Travel, Transportation, Meals,

Factors That Determine Tax Home

The following three factors are used to determine tax home if the taxpayer does not have a regular place to work.

- Firstly, the taxpayer performs part of their business in the area of the main business home and uses that home for lodging while doing business in the area.

- Secondly, the taxpayer has living expenses are the business home that

are duplicated because the business requires the taxpayer to be away from that home. - Lastly, t

he taxpayer has not abandoned the area in which both is the historical place of lodging and that the taxpayer has claimed is the main home. Or the taxpayer often uses the home for lodging.

Satisfying these three requirements means that the taxpayer’s home is where they regularly live. Depending on all of the facts and circumstances, by satisfying only two of these requirements, it may be considered a tax home. Satisfying one factor means the taxpayer is itinerant; that tax home is wherever the taxpayer works and the taxpayers cannot deduct travel expenses.

Source: IRS Publication 463, Ch 1, Travel

Download Falcon Expenses, Free

The longer you wait to get started with Falcon the more tax deductions and reimbursements you miss out on. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

About Falcon Expenses

Falcon Expenses is a mobile application for expense tracking and reporting. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait the more tax deductions you miss out on.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client and easily prepare reports to email to anyone in PDF or spreadsheet formats, all from your phone. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, business travelers, delivery drivers, truckers, and more.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com