What Does an EIN Number Look Like? (It’s More Familiar Than You Think)

Table of Contents

The IRS issues EIN numbers. An EIN is an important number. However, what should an EIN number look like?

You’re probably wondering what should an EIN number look like?

Or, how long is a EIN number?

Particularly if you’re self-employed or a small business owner. This question is also popping up in your head if you need to hire employees or independent contractors.

Read this post to learn how to do a tax ID number lookup.

What does an EIN number look like?

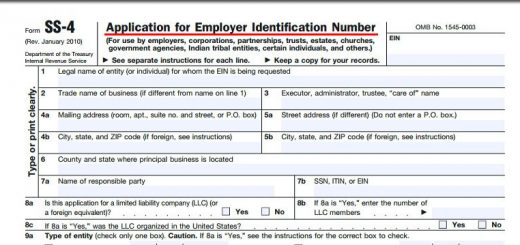

An EIN looks like the following format: XX-XXXXXXX.

The first two numbers of an EIN are separated from the last seven numbers.

Check out Falcon Expenses if you’re a small business owner and need a simple way to automatically track and organize business expenses. Falcon customers record over $6,600, on average, in annual tax deductions. Get started today.

Download Falcon Expenses, Free

The longer you wait to get started with Falcon the more tax deductions and reimbursements you miss out on. If you’re on a desktop it’s best to use your phone and search for Falcon Expenses on the app store.

Scroll down for resources to learn more about Falcon Expenses mobile expense tracker app.

This is what an EIN number looks like, with the letter ‘X’ used instead of numbers.

XX-XXXXXXX

How long is a EIN number?

Ever wondered how long is a EIN number? An EIN number is nine-digit number issued by the IRS.

What is an EIN number used for?

The United States IRS uses your EIN to identify your business for tax purposes. Another name for an Employer Identification Number is a Federal Tax Identification Number (FTIN).

An EIN number is required to file taxes as a separate entity. Without an EIN number as a self-employed individual, you would file your taxes using your Social Security number (SSN). With an EIN, a business owner doesn’t have to use their personal Social Security number in order to file taxes for their business.

Who is required to have an EIN?

Some business entity structures require an EIN number. Business structures that require an EIN include:

- a corporation (if your business ends in ‘, Inc.’)

- an LLC (Limited Liability Company)

- a partnership

We recommend that you get an EIN as soon as you incorporate.

Review our guide about EINs for more information about who is required to have an EIN and how to get one, Do I Need an Employer Identification Number (EIN) and How to Get One.

Also, check out this post if you are just starting to research about EINs and you would like to know the benefits of an EIN: 7 Benefits of an Employer Identification Number (EIN).

Am I required to have an EIN number if I’m self employed?

An EIN number is not required for self-employed. However, there is nothing that says you can’t get one. When you have an EIN number the only difference is you use your EIN number to do your self-employment taxes, instead of your social security number.

Check out this informative article for more information on self employment taxes, Self Employment Tax Deductions (Some Might Surprise You).

Also, check out this article if you’re wondering, how do I do my taxes if I’m self-employed?

What is an IRS Schedule C Form (and What You Need to Know About It).

How do I apply for an EIN?

The IRS (Internal Revenue Service) provides a free service for applying for an Employer Identification Number.

Review this article for the complete details about how to apply for EIN: Do I Need an Employer Identification Number (EIN) and How to Get One.

How do I find my EIN number? How do I do a tax ID number lookup?

There are many ways to do an employer identification number lookup locate if you already have an EIN number but misplaced it. Below are the top options to locate your misplaced EIN number. In addition, there is a link to a page on the IRS website with all of the details about how to locate your misplaced EIN.

Locate the Computer Generated Notice

To do this, simply do a search for ‘EIN’ or ‘Employer Identification Number’ in your email inboxes. Once you have done this search, any email that you received, which contains these words, will show up in the search results.

Contact Your Bank

If you used your EIN to open a business bank account then your bank will have this number. Therefore, all that you need to do is contact your bank.

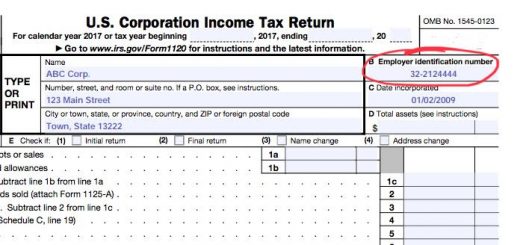

Previously Filed Tax Return

Your company’s EIN is on any company tax return that you have filed. Therefore, just pull up an old return to locate your misplaced EIN.

Contact the IRS

Contact the IRS if none of the options above work for you to locate your EIN. Contact the Business & Specialty Tax Line at 800-829-4933 to locate a misplaced EIN number.

Review this page on the IRS website for more information about how to locate your EIN: Lost or Misplaced Your EIN?

About Falcon Expenses

Falcon Expenses is a mobile application for expense tracking and reporting. Falcon customers record over $6,600, on average, in annual tax deductions. Get started today. The longer you wait the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client and easily prepare reports to email to anyone in PDF or spreadsheet formats, all from your phone. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, business travelers, truckers, and more.

Check out the following articles for more information about Falcon Expenses features and services:

- Manage Receipts with Falcon Expenses

- Track Mileage Expenses with Falcon Expenses

- Falcon Expense Report Template & What Expense Reports Look Like

- What’s Included in Falcon’s Mileage Expense Log

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com