7 Benefits of an EIN Number (Employer Identification Number)

Table of Contents

Key benefits of an Employer Identification Number and why your business needs one regardless of how small your business is.

What is an Employer Identification Number?

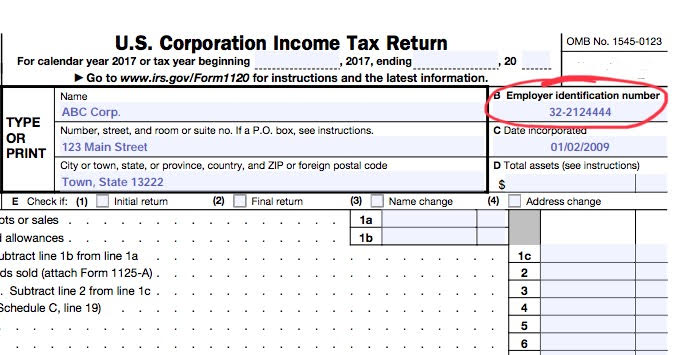

An Employer Identification Number is also known as an EIN. The Internal Revenue Service (IRS) issues EIN numbers. The IRS uses EIN numbers to identify a business for tax purposes. Another name for an EIN is Federal Tax Identification Number.

An EIN is a nine-digit number and looks like a social security number. Federal Tax Identification Numbers are for tax purposes. The IRS issues EIN numbers to identify your business and for tax reporting purposes. EIN numbers are also for many other purposes. Having an EIN is also good for protecting your personal information.

Companies that plan to hire employees or have plans to hire employees in the future are typically required to have an EIN. Also, certain business structures require an EIN, such as a corporation (C and S corps), partnership, or a limited liability company (i.e. an LLC). Sole proprietors and DBA’s (Doing Business As) are not required to have an EIN number. For self-employed and independent contractors a Social Security Number is typically enough. However, most self-employed and independent contractors will want an EIN number after reading the many benefits of an EIN in this article

EIN numbers do not expire. Therefore, you don’t have to have one reissued annually, or ever, once you have one. This means there’s no extra work of renewing an EIN.

How do you get an EIN?

The easiest and fastest way to get an EIN is to apply online. Also, you can get an EIN by mail, fax or telephone. For specific details about how to get an EIN, including links to the appropriate IRS.gov pages, go to this article, Do I Need an Employer Identification Number and How to Get One.

What are the benefits of having an EIN number?

Benefits of an EIN Number

1. Avoid Fines and Penalties

Some businesses are required to have an EIN.

An EIN might be required even if your business is small, such as a freelancer or sole proprietor.

Further, a business that’s required to have an EIN, but doesn’t have an EIN and files business taxes without one, is subject to fines and penalties.

Does your business need an EIN?

If your business has employees then you need an EIN.

However, that is an oversimplified explanation of who is required to have an EIN.

Even if you’re a small business, self-employed, a freelancer, or an independent contractor, you might be required to have an EIN. EINs are not only required for large companies, this is a common misconception.

For a detailed and complete understanding of what businesses are required to have an EIN please review our article, Do I Need an Employer Identification Number and How to Get

Make sure to apply for an EIN number well before your taxes are due if your business is required to have an EIN. This is because, depending on how you apply for your EIN, the can take up to five weeks before receiving it from the IRS. Other than filing business taxes, an EIN is needed for changing organization type or for establishing trust, retirement, or pension plans. Also, an EIN is required for purchasing an ongoing business.

2. Identity Theft Protection

You no longer need to use your Social Security Number for your business taxes when you have an EIN.

Therefore, your Social Security Number is exposed to outsiders and strangers less. Thus, it is less susceptible to theft, resulting in identity theft.

For example, when you’re employed by another company to provide your services, you provide a Federal Tax Identification Number. EIN numbers protect self-employed and independent contractors from identity theft.

Surprised to hear that?

Well, it’s true.

Having an Employer Identification Number separates your business finances from your personal finances.

Once you get your EIN give it to your vendors instead of your SSN. Therefore, your personal information is private. An SSN is private and could be stolen. Using an SSN regularly for different clients and transactions makes the chances of identity theft higher.

3. Credibility

Providing your clients with an SSN or an EIN is necessary for doing business if you’re a freelancer or if you work as an independent contractor. However, an Employer Identification Number adds professional credibility to your name and brand that a social security number cannot. This helps bring new customers. This is because an EIN is only for business use, not personal use like an SSN. Therefore, it also signifies that you have a real business and you take your work seriously.

4. Professionalism

Providing a client with an EIN, as opposed to your Social Security Number is simply more professional.

It’s also attractive for companies to see that you’re an independent contractor as proven by the Business tax ID or better known as EIN, rather than an employee hence increasing your chances of getting hired.

Also, one of the benefits of a business bank account is increased professionalism. Therefore, if increasing your level of professionalism is important to you and your business we recommend considering opening a business bank account if you have not already. Even for self-employed and independent contractors, a business bank account has many benefits.

Related:

Can a sole proprietor have a business bank account?

How to Open a Small Business Bank Account

Requirements for Opening a Business Bank Account: The Ultimate Guide

Do you need an EIN to open a business bank account?

Yes. You need an EIN to open a business bank

Still not sure if you should open a business bank account and wondering what the benefits of opening a business account are?

Check out this article, Benefits of Having a Business Bank Account.

5. Get Business Loans Easier

To get a business loan having a business bank account makes it easier.

An Employer Identification Number speeds up the business loan application process. Many lenders may not require you to have an EIN and would provide you with the loan if you have the necessary documents and licenses. However, most business lenders require you to have a business account, which is not possible without an EIN.

Related:

Business Loan versus Personal Loan

What are the different types of business loans (a complete comparison)?

How to Get a Business Loan Approved

6. Establish Business Credit and Trust

When a business has a bank account it builds credit with the bank.

Often vendors and prospective clients will want to check a business’s credit before doing business with you.

This is similar to checking an individual’s credit before doing business with an individual.

Therefore, build trust with your vendors by having good business credit. In order to build and have good business credit, you first need a business bank account. To get a business bank account you need an EIN.

7. Easier to Grow

Having an EIN makes it easier to expand your business if you plan on growing.

One reason for this is that you can’t hire employees unless you have an EIN.

Imagine this, your business is growing rapidly, and all of a sudden you need to bring on extra help, as you can no longer survive alone. Also, the extra help that you need is someone who is a full-time employee, not a contractor.

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

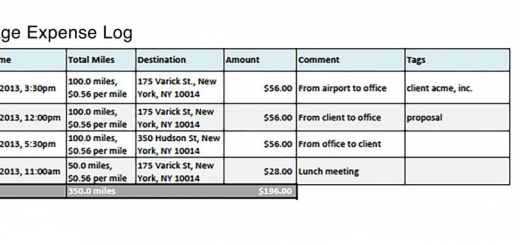

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data to email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Conclusion

We think that every self-employed sole proprietor should have an EIN.

Why do we feel this way?

Here’s why.

To stay in business your business needs to continue to grow. This means it’s important to keep your intentions aligned with your business needs. Therefore, your need to be prepared for your business growth is aligned with your intention to grow. With that said, you need an EIN if you intend to grow.

Falcon Expenses blog is a community of self-employed and small business owners. We would love to hear your story if you recently evaluated whether or not you needed an EIN.

Did you decide to get an EIN?

What were the reasons you decided to get an EIN?

Sharing your story with our community helps others just like you on their journey as a small business owner.

Please share your story in the comments. Or email us at support@falconexpenses.com if you are interested in sharing your story with the Falcon community in a dedicated article.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.