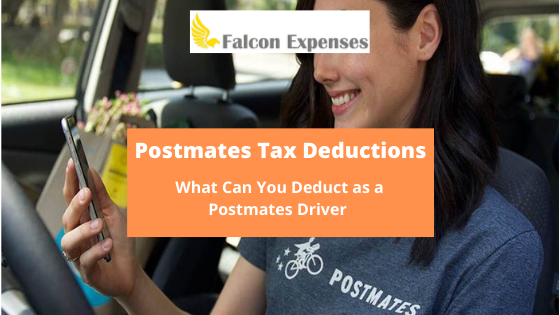

Postmates Tax Deductions, What You Can Deduct

Table of Contents

This article is the ultimate guide for Postmates tax deductions. Read to learn about Postmates driver tax deductions.

Postmates Tax Deductions Back Story

Postmates drivers are self-employed.

This means Postmates drivers are eligible for Postmates 1099 tax write-offs such as self-employment tax deductions.

With that said, Postmates driver self-employment means it’s important to understand the proper way to account for unique delivery driver tax deductions. This empowers Postmates drivers to maximize their take-home income.

Other Postmates driver advantages include autonomy over work schedule and personal life.

This means as a Postmates driver you don’t report to an office every day where you sit at a desk with your eyes glued to a computer. Instead, you’re a small business. Further, as a Postmates driver, you need to make sure there’s enough incoming business (i.e. deliveries) and you have to manage unique business expenses.

There are many new, often unfamiliar, tax deductions a Postmates driver can deduct from their gross income. Many of these tax deduction opportunities are for expenses related to the car or vehicle used for deliveries. For example, the cost and expense for the operation of the delivery car. Therefore, there are certain deductible expenses whether it’s your car or a car provided by an employer or car rental company.

Lastly, we recommend checking out this article if you’re a delivery driver in need of a way to conveniently organize your vehicle expenses: Simplified Ways to Track and Organize Vehicle Expenses.

What expenses can I write off?

Mileage

As a Postmates driver, you’re self-employed.

This means you can deduct non-commuting business mileage. This includes the miles you drive with your car for your delivery drivers, including delivery pickup. It also includes your drive back home when you are finished working for the day.

Most Postmates drivers use a mileage tracker app that automatically tracks their mileage in the background so they never miss a mile.

The IRS provides two ways to write off mileage, which are explained below.

The most common way for delivery drivers to write off mileage is with the Standard Mileage Rate method. Mileage write-offs with the Standard Mileage Rate method are calculated using a per-mile rate provided and updated by the IRS each year. Basically, you multiple each mile you drive for work by this rate and you have your mileage write-off amount.

Tolls

All tolls you pay for while driving for work are tax write-offs. Unless they are being reimbursed to you, write them off.

Parking

Any parking fees you pay while working are also tax-deductible. So save those receipts.

Phone and Service

Self-employed on-demand workers need phones, phone services, and phone accessories to do their job. The proportion used for work of the expenses for these items is a tax deduction.

You can calculate the proportion of the expense for these items and services by using the same formula that is used to calculate roadside assistance expense proportions.

Inspections

Any car inspections or background checks you are required to get as part of your delivery job are also tax-deductible. For example, if Postmates insists that your car be inspected before you start working you can write off the cost of this inspection and any future inspections.

Roadside Assistance

Roadside assistance programs are tax-deductible. For example, your AAA fees.

Make sure that you only deduct the percentage of your fees that is for work.

How to calculate roadside assistance write off amount

A simple way to calculate your roadside assistance tax deduction is to take the total number of all miles you drove for the year and determine what percentage of those miles were for work.

You can quickly determine the total number of miles you drove for work if you use a mileage tracker app like Falcon Expenses.

This calculation would look something like this:

Total miles driven = 15,000

Total miles driven for work = 9,000

% Miles driven for work = (9,000/15,000) x 100 = 60%

Total roadside expenses for the year = $1,000 x 0.60 (i.e. 60%) = $400

Total roadside assistance tax deduction = $400

Health Insurance

The IRS allows you to write off your health insurance premium if you’re self-employed.

Business Licenses

Some cities require business licenses to be a courier or delivery drivers. Business license fees are tax-deductible.

Courier Bags, Hot Bags, and Blankets

Many delivery drivers purchase insulated blankets and bags to keep food warm. The expense of purchasing these items falls under an ‘ordinary and necessary’ business expense.

Therefore, it is tax-deductible.

Your Falcon Subscription

The price of your Falcon Expenses mileage tracker and expense tracker app is tax-deductible.

How to Choose a Mileage Expense Deduction Method

For deliveries done by personal car, you need to choose a mileage expense tax deduction method. The IRS offers two ways to deduct mileage expenses.

You must stick to one method for the entire tax year. What this means is you can’t use the Actual Car Expense Method for half the year and the Standard Mileage Rate for the other half of the year.

- Actual Car Expense Method

The actual car expense method is a method where the tax payer deducts each individual expense. For example, the tax payer deducts depreciation, registration fees, lease payments, etc., separately. - Standard Mileage Rate

The standard mileage rate is a method of deducting car expenses using a per mile driven amount. The IRS predetermines this amount. Think of it as a Postmates mileage reimbursement rate. Use this method if you own or lease your delivery vehicle. For the last 5+ years this amount has been in and around fifty cents per mile. Many Postmates drivers prefer to use an auto mileage tracker app when using this method.

Standard Mileage Rate Pros

All expenses are included in a single per-mile rate.

Therefore, you don’t spend a lot of time itemizing each expense (as done in the Actual Car Expense method).

Each year the IRS takes into consideration the cost of fuel, maintenance, and the current economic environment to calculate the standard mileage rate.

This method is more straightforward and often easier for many. All you have to do is create an organized mileage report that meets the IRS mileage record-keeping requirements.

Review the following article for detailed information about each of these deduction methods, which one to choose, and how to use them, Actual Car Expense Method vs Standard Mileage Rate.

Standard Mileage Rate Method

Please refer to the following article for the most up-to-date per mile rates if you use the standard mileage rate method, IRS Standard Mileage Rate.

Self Employment Tax

There are also taxes you should be aware of as a Postmates driver. For example, Medicare and Social Security Taxes. Did you know that self-employed individuals pay their own Medicare and Social Security Taxes? Don’t worry, we’ve got you covered.

Check out these articles for all that you need to know on Postmates driver self-employment tax:

What is Self Employment Tax?

Doing Your Own Taxes?

If you’re doing your own taxes, then you probably want to become familiar with how to fill out a Schedule C.

A Schedule C is where self-employed individuals report income or loss from a business they operated. This is the form you would file to do your self-employment taxes.

What are the top Postmates Write Offs?

Mileage and vehicle-related expenses are unarguably the top expense deductions for Postmates drivers.

What are the Commonly Overlooked Expense Deductions for Postmates Drivers?

It is not uncommon for delivery drivers and couriers to overlook miscellaneous business expenses. For example, expenses for items and services used specifically for work such as expenses for car maintenance (for those using the actual expense method), the cost of phone supplies such as car mounts, etc. With that said, most items you purchase to use as part of your work are likely deductible. They are at least partially deductible if not completely tax-deductible.

Read the following article for details about self-employment tax, What is Self Employment Tax?

About Falcon Expenses

Falcon Expenses is a top-rated mobile application for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss out on.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily prepare expense reports for email to anyone in PDF or spreadsheet formats, all from your phone. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, business travelers, couriers, truckers, and more.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com