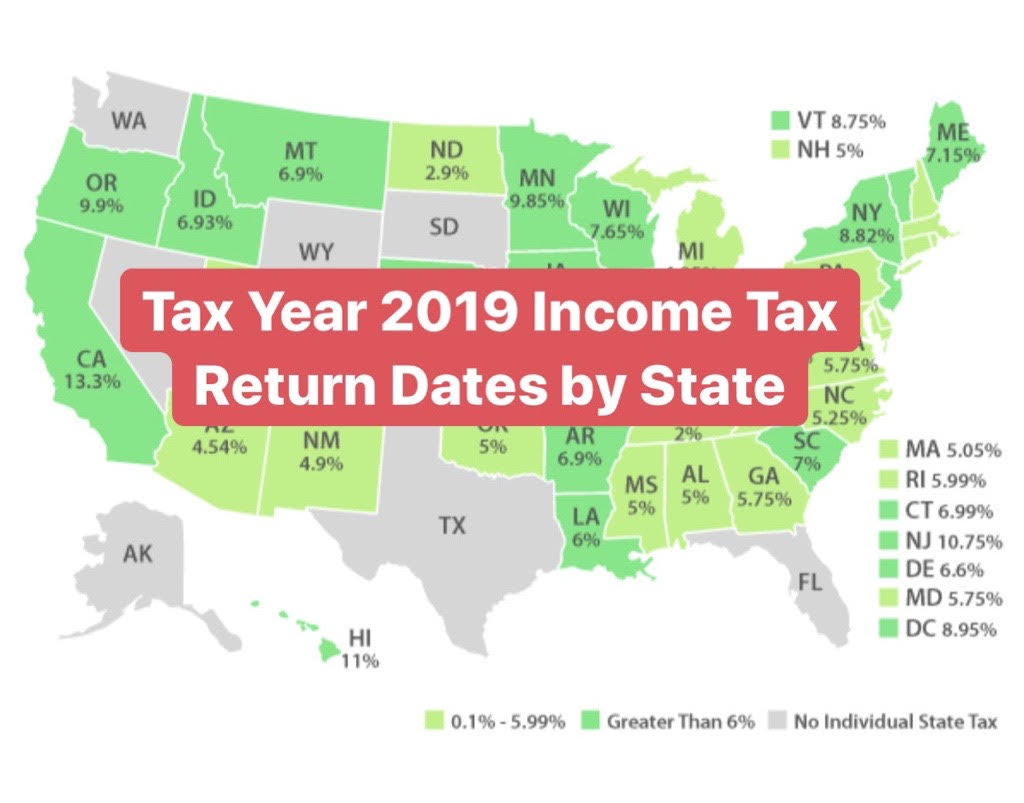

What are the 2020 Personal Income Tax Deadline Dates by State?

Table of Contents

This article contains the 2020 personal income tax deadline dates for each state for the 2019 tax year.

No one wants to miss the tax deadline date for personal income taxes, as this often results in penalties and unnecessary hassle. Below is a chart that contains the tax deadline dates for personal income taxes accrued during the 2019 tax year. More specifically, between the dates of Jan 1st, 2019, and Dec 31st, 2019. Bookmark this article as it will be updated with important information such as tax extension dates, amendment dates, etc.

How can I lower my income taxes?

Everyone wants to know how to reduce their income taxes. For those that are self-employed one of the easiest ways to do that is to become aware of the many tax-deductible expenses. There are many tax-deductible expenses available to self-employed, freelancers, and contractors. These deductions are made possible to help ease the extra costs associated with being independent versus being employed. So why not take advantage of them?

What expenses can small businesses and independent contractors write off?

Travel Expenses

Travel to and from client locations is often deductible even if it is by bus, train or personal call.

Meals and Entertainment

For meals and entertainment that are part of doing business 50% is typically deductible as a business expense.

Office Rent (Including Home Offices)

In regards to home offices, the percentage of your rent that is used as part of your business office is often tax-deductible as a business expense.

Please check out this article for more information about tax-deductible business expenses and business expense record keeping requirements, IRS Rules for Recording Business Expenses: Travel, Transportation, Meals and Entertainment.

Falcon Expenses is a fully mobile expense tracking app that makes it easier to keep track of business expenses, saving you time and money. Falcon Expenses scans receipts, tracks mileage expenses (with three different features including an automatic GPS tracker). Learn more about each of the Falcon Expenses features by reviewing any of the following articles:

- How to Scan and Manage Receipts with Falcon Expenses

- How to Track Mileage Expenses with Falcon Expenses

- Falcon Expenses Expense Report Template & What Expense Reports Look Like

- What is Included in Falcon Expenses Mileage Expense Log

About Falcon Expenses

Falcon Expenses is a top-rated expense and mileage tracker app for self-employed and small businesses to track expenses and tax deductions. Falcon customers record $6,600, on average, in annual tax deductions. Get started today. The longer you wait, the more tax deductions you miss.

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client. Easily create expense reports and mileage logs with your expense data to email to anyone in PDF or spreadsheet formats, all from your phone. Falcon’s expense report template is IRS compliant. Use for keeping track of tax deductions, reimbursements, taxes, record keeping, and more. Falcon Expenses is great for self-employed, freelancers, realtors, delivery drivers, couriers, business travelers, truckers, and more.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com