How Does the IRS Define Commuting?

Table of Contents

Read this article to learn how the IRS defines commuting. Also learn what commute and business transportation expenses are tax deductible.

What is the IRS definition of commuting?

The IRS defines a commute as ‘transportation between your home and your regular place of work’.

What is a regular place of work?

A regular place of work is a location where you have worked for more than a year. This would be the office location that you travel to on a regular basis for work. For example, most people commute between their home and their regular place of work Monday through Friday. The commute can be by driving a personal car, by train, bus, or even walking.

Can I deduct transportation expenses for personal car use to commute to a regular place of work?

No.

If you use your personal car to commute to a regular place of work the expenses incurred during this transportation are not tax-deductible. These expenses include gas, wear and tear on the car or vehicle, maintenance, etc. Also, the same is true when a train, bus, taxi, or any other form of transportation is used to commute to and from a regular place of work. However, if the employee has more than one work location, the commuting expense between the two locations is tax-deductible.

What is defined as tax deductible business transportation?

The following types of business transportation are tax-deductible by the IRS:

- Business meals and entertainment

- Customer visits

- Airport / Travel

- Travel between offices (that are different from a regular work location)

- Temporary job sites

- Errands / supplies

- Odd jobs

What qualifies as a temporary work location?

A work location would qualify as temporary if defined in advance as for a duration of less than a year. Different travel and expense deductions apply to temporary work locations. Please read the following article for more information about temporary work locations, Temporary Work Locations and Commuting Expenses Tax Deductions.

What transportation expenses can I deduct?

There are two options for how to deduct for qualified tax-deductible business transportation if you use your personal car.

- Standard Mileage Rate Method

Each year the IRS publishes a per mile amount standard mileage rate that is used to calculate mileage expense tax deductions.

This is also the minimum amount that employers must reimburse their employees for if employees or contractors use their car for qualifying tax deductible business use. Sometimes, employers offer to reimburse employees an even larger amount than the standard rate for employee person use of car.

The idea with the Standard Mileage Rate method is that all of the line items of the transportation expense, such as wear and tear on the car, and maintenance, are included in the per mile amount. In some cases this is more convenient that calculating line items. - Actual Car Expense Method

This details the method for calculating each item of the car expense from gas, to wear and tear on the car, to maintenance etc.

Depending on the circumstance one method might maximize qualified expense deductions over the other. Check out the following article for more information on these methods, How to Maximize Business Use Car Tax Deductions.

How do I keep track of my tax deductible commute expenses?

You can use a mobile app like Falcon Expenses, which conveniently allows you to log your mileage and/or vehicle expenses while you are on the go. Therefore, never forget an expense, and you maximize your deduction. Falcon Expenses offers a few ways to track mileage expenses.

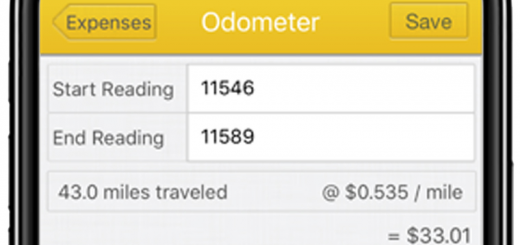

- Odometer Log

Enter the start and end odometer readings of a trip.

Falcon calculates the miles driven and the expense reimbursement amount based on the custom reimbursement rate set in the app.

Check out this article for more information, Falcon Expenses Odometer Log Feature. - Trip Addresses

Enter the start and end address of the tax deductible commute or transportation.

Falcon Expenses will calculate the miles of the driving distance and the expense reimbursement amount.

Check out this article for more information, Falcon Expenses Addresses Feature. - Auto GPS Mileage Tracker

Use an integrated GPS tracker to track tax deductible business transportation miles as the miles are driven.

Falcon Expenses will calculate the deductible mileage expense amount for your when the trip is complete.

Check out this article for more information, Falcon Expenses GPS Tracker.

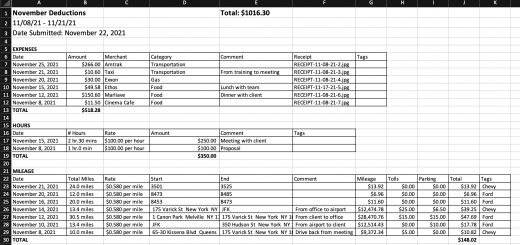

Falcon Expenses also offers other features such as a receipt tracker and scanner, a time logger. Many of these features come in handy if you are using the Actual Car Expense method for your transportation expense deductions. Further, after all of your expenses are captured and safely stored in Falcon.

After, quickly organize expenses into expense reports. Then, export reports in PDF or spreadsheet format all from your phone. Basically, Falcon Expenses has everything for your expense tracking and reporting needs.

About Falcon Expenses

Falcon Expenses is an expense and mileage tracker app. Scan receipts, we type merchant, date, and amount, auto-track mileage expenses via GPS, and log billable hours with an integrated timer. Quickly organize expenses by time period, project, or client and easily prepare reports to email to anyone in PDF or spreadsheet formats, all from your phone. Use for reimbursements, taxes, record keeping, or invoicing. Falcon Expenses is great for professionals, freelancers, realtors, business travelers, truckers, delivery drivers, couriers, and more.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com