Best App to Log Mileage

Table of Contents

Are you wondering what’s the best app to log mileage? Do you use your car for work and need a reliable mileage tracker app for business?

Do you drive your personal car for work?

Are you a delivery driver for DoorDash or Postmates and looking for the best mileage tracker app for delivery drivers?

Many self-employed individuals and freelancers, such as DoorDash delivery drivers, drive their personal cars for work. There are tax deductions to take advantage of if you drive your car for work.

For example, did you know you can deduct a certain dollar amount from your taxes for the miles that you drive for work?

If you answered, No, to this question, we suggest you check out this resource before continuing:

What mileage can I write off on my taxes?

Otherwise, keep reading.

We have lots of valuable information in store for you.

The first step in taking advantage of the IRS mileage tax deduction is to keep track of the number of miles you drive so you can calculate your mileage tax deduction.

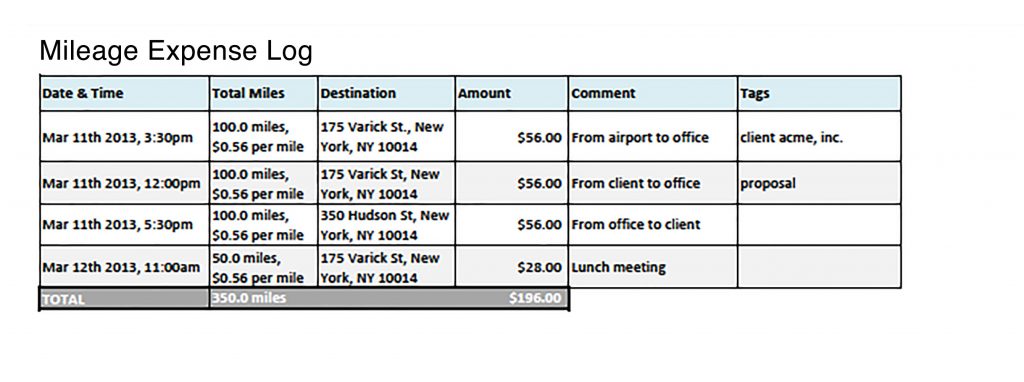

What is a mileage log?

A mileage log is a log of the mileage you have driven. Self-employed individuals that want to write off miles from their taxes need to track the number of miles they drive. The most common way to do track mileage is to use a mileage log.

The idea of a mileage log to keep track of business mileage is quite simple. Each time you drive for work you log the total number of miles you drove.

However, the IRS has specific requirements about what they want to be included in an IRS compliant mileage log.

An IRS compliant mileage log looks like this:

How to track mileage

Many self-employed individuals are probably wondering how to track car mileage.

How to track mileage can be either tedious or convenient, and easy.

Let us explain.

There are three primary ways how self-employed log mileage for business:

- The old-school, tedious, way of using pen and paper, or

- A mileage expense report template in excel (often the pen and paper mileage log is transferred to an mileage log in excel)

- The most convenient way to log mileage is with a Mileage Tracker App for Business.

With a mileage tracker app, everything is done for you, automatically. The distance you travel is calculated from your start and end odometer readings, and from that distance, your mileage expense amount is calculated using the IRS mileage rate for that year.

What is a mileage tracker app for business?

You should probably educate yourself on the top mileage tracker app features so that you are equipped with understanding what features you need to support your needs in a miles tracking app.

How to use a mileage tracker app for taxes?

Self-employed use mileage tracker apps to track their tax-deductible mileage. Mileage tracker apps offer the convenience of auto-mileage tracking and automatically calculating your mileage expense for you.

How freelancers use mileage tracker apps for taxes is simple. Freelancers and independent contractors regularly log the miles they drive with a mileage tracker app. They do this either by manually entering the number of miles driven or letting the app do the mileage expense calculations for them.

Or they take advantage of the advanced technology of a mileage tracker app.

Can I claim mileage on my taxes?

Check out this article for a full guide about if you can claim mileage on your taxes, and what mileage you can write off:

Can I claim mileage on my taxes?

What is the best mileage tracker app for business?

By now you’re probably wondering what’s the best app to track mileage for taxes and business.

The best mileage tracker app for business is Falcon Expenses mileage tracker.

Falcon Expenses is the best mileage tracker app for three main reasons:

- It’s simple (i.e. easy-to-use)

- It’s flexible

- It’s reliable and accurate

Falcon is Simple

When Falcon Expenses first launched it was quickly rated by a number of major publications as one of the easiest to use mileage and expense tracker apps. For example, About.com rated Falcon as one of the top three expense and mileage tracker apps.

Falcon continues to strive to maintain its simplicity so that anyone who uses the app quickly finds their way in the user experience and is able to use the app with ease.

Falcon is Flexible

Falcon Expenses mileage tracker app has three ways to track tax-deductible mileage expenses.

Therefore, pick the mileage tracking method that’s most suitable for you, and your daily, weekly, or monthly workflow.

Odometer Log Mileage Tracking Method

Use Falcon Expenses to enter start and end odometer readings and Falcon will calculate the number of miles (or kilometers) that you traveled for work.

After, Falcon will calculate your business mileage expense amount.

Falcon calculates your mileage expense amount based on the per-mile mileage reimbursement rate, or mileage deduction rate, you set from the settings page.

Odometer Logging Power Feature

A power feature of Falcon’s automated odometer log is you can enter your start odometer reading at the beginning of your day.

After, do all of your business driving throughout the day.

Then at the end of the day open Falcon Expenses, the start odometer reading you entered will still be there. Then all you have to do is look at your odometer, which will have been incremented forward by the number of miles you’ve driven throughout the day, and enter your end odometer reading.

Auto GPS Tracker

An auto mileage tracker is great for those that prefer to completely automate their mileage tracking.

With Falcon’s auto mileage tracker your phone’s GPS is used to track your mileage in the background while you drive. There is no need to manually enter any readings as it is tracking as you go. Falcon’s auto mileage tracker has been tested rigorously to verify its reliability and accuracy. This means, you can be confident that it won’t crash mid-drive, and that it tracks the miles you actually drive, no more or no less.

Check out this article to learn more about Falcon’s auto mileage tracker, including how to use it:

A Value-Packed Overview of Falcon’s Auto Mileage Tracker, Why it’s Better, and How to Use it

Business Trip Addresses

Falcon’s Business Trip Addresses feature works by calculating the distance of your business trip from the start and end address of your work trip. It is simple to use, all you have to do is enter the addresses and it does the rest of the calculations for you.

Also, it remembers your most-used addresses.

In addition, Falcon’s business trip addresses feature is integrated with Google Maps and as a result, it makes suggestions of addresses, and locations, as you type, making the process of entering your mileage expenses that much easier and that much faster.

Falcon uses the mileage distance measured between the start and end addresses entered to calculate the amount of the mileage expense deduction. The custom mileage expense reimbursement rate that you set in the app (FYI, most people use the IRS standard mileage rate for the given year).

All of this powerful functionality makes creating a mileage report easy and less time-consuming.

Falcon is Reliable and Accurate

Many auto mileage tracker apps have two main issues:

- They don’t accurately track the distance you drive. Simply put, their GPS trackers are not precise.

- Their GPS trackers are not reliable. This means that sometimes, while you’re driving, they crash mid drive. This leaves you in the position of not having adequate records for your mileage log. Or, simply forgetting a tax deductible drive and this missing out on the tax deduction from your gross income.

Both of these problems are eliminated with Falcon Expenses.

After hundreds of hours of testing, both in our lab and in the real world, Falcon Expenses has proven to not crash while running in the background on your phone and tracking your mileage. Many competitor apps and other apps on the market sometimes, or even, often crash, while running in the background, ultimately resulting in the taxpayer, like yourself, losing and missing out on potentially hundreds of dollars in tax deductions or mileage reimbursements.

In addition, through this testing, we’ve demonstrated that Falcon Expenses accurately tracks the actual number of miles you have driven. Not overestimating or underestimating your total distance traveled. Therefore, you get an accurate calculation of your mileage tax deduction amount or your mileage reimbursement amount.

Resources for Delivery Drivers

Many self-employed individuals that have a need for tracking mileage are delivery drivers for companies such as DoorDash, Postmates, UberEats, Etc.

Therefore, with that said, we have compiled a list of resources that might be helpful for couriers and delivery drivers in case they come across this article.

Can you write off mileage for DoorDash?

What miles can delivery drivers deduct?

Delivery Drivers Tax Deductions

Postmates Tax Deductions

Conclusion

Using your personal car for work is convenient.

In addition, there are tax benefits, such as tax deductions to take advantage of if you do so.

However, the most common way to take advantage of the tax write-offs available to self-employed individuals for driving their car for work requires them to keep a mileage log. The most convenient and least time-consuming way to do this is by using advanced technology offered in a mileage tracking app.

The best mileage tracking app on the market for this is Falcon Expenses top-rated expense and mileage tracker.

Was this article helpful?

I used to travel a lot for work. Doing my expenses frustrated me. I would delay submitting them and when I did, I would spend hours taping receipts to paper to scan for my boss. I knew there was a better solution, and I had a background in productivity software, so I created Falcon Expenses. I enjoy creating software that makes people’s lives easier.

In addition, I’m an avid skier and I enjoy hiking, sailing, and cooking.