Effective Ways to Protect Your Business from Inflation

Economists have been speculating for a while that a major wave of inflation is about to hit. While many are panicking and saying you can do nothing, we believe preparation is the key to surviving any crisis. This wouldn’t be the first time we face a major recession, and it surely won’t be the last. When the previous significant inflation hit, some companies struggled; however, there were businesses that managed to get by just fine. Both recession and inflation function like a tide, and there are always businesses that somehow manage to stay afloat. To help you weather the storm, we will offer you several effective ways to protect your business from inflation and prepare for what comes next.

Understanding Inflation

Before we look at ways to protect your business from inflation, let’s first explain what inflation is. When there are fewer goods than money on a given market, the situation naturally attempts to self-adjust through increasing prices. Basically, when demand outpaces supply, you’ve got fewer goods to purchase with your money, so that money is worth less. Since multiple buyers are competing over the same goods, prices will increase. Unfortunately, an increase in the price of one good, such as petrol, can drive up other costs. Small companies are especially vulnerable since they can get caught in a chain reaction of price increases.

In extreme cases, employers need to increase wages when prices go up beyond what the market can stand. They must raise salaries so that the public can be able to afford the products which are now more expensive. Unfortunately, instead of solving the problem, the increase in purchasing power only worsens matters. Now we are back to the first problem of having more money available on the market for the same goods. This behavior can cause the cycle to repeat and inflation to continue.

Many different circumstances can cause inflation. It can happen when a sudden increase in available money on the market isn’t supported by economic growth. Supply can’t catch up with demand since the public has more to spend. However, inflation can also occur when supply chains get disrupted, and we’ve seen much of that in the last few years. The COVID epidemic and the Ukraine crisis have disrupted global supply chains, and economists fear that we are yet to see the full effects.

How to Protect Your Business from Inflation

Improve Your Productivity

It is time to go back to your business plan. Look at what you are making and how you are making it. You will need to learn how to do more by spending less. Unfortunately, that’s often easier said than done. We suggest mapping out in detail every process your business performs. Examine every single activity that goes into your regular operating procedures. Find a way to cut the excess fat and make your business as lean as possible. This strategy can be particularly effective for companies that rely on large amounts of manual labor. The efficiency of most manual jobs can be at least somewhat improved, and saving just a few hours per week can quickly add up.

Watch Your Expenses

One of the most effective ways to protect your business from inflation is to be extremely careful about your spending. Now is the time to be frugal; however, most businesses often don’t pay much attention to petty cash and small expenses. Nonetheless, with rising costs, those expenses probably aren’t that small anymore. You can use our app to help you generate an expense report. Our mileage and expense tracker can be a lifesaver for small and self-employed businesses that don’t have large accounting departments to keep track of every expenditure.

Lower Your Operating Costs

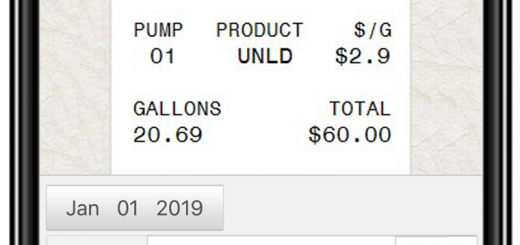

Most business owners would have trouble lowering their day-to-day operating costs. For many companies, their commute and mileage expenses represent a significant business cost. An excellent way to reduce operating costs is to measure and reduce your mileage expenses, especially since gas prices are rising.

Supply is another core component of everyday operating costs for most businesses. Therefore, you should revisit your supply chain and see if there is a way to diversify to lower your reliance on individual suppliers. Start creating backup supply chains and research alternatives for existing suppliers. Look into domestic businesses instead of relying on overseas shipments for core goods.

Implement Automation

We live in a digital age, and if you can automate something, there is no excuse not to. At Falcon Expenses, we rely on apps and software tools for most mundane and repetitive tasks. Automation can reduce reliance on physical labor if you need to reduce expenses. However, implementing modern apps is also a way to free up work hours for your staff and allow them to spend that time more productively. One of the best ways to protect your business from inflation is to let your employees do what they do best – directly interact with clients instead of spending time on data entry, report generation, and creating email lists.

Cancel Unnecessary Subscriptions and Services

Comb through your service contracts to see exactly what you are paying for and for which services. Draw a hard line and determine which services are necessary and which are superfluous expenses. You may be caught up in contracts that you can’t get out of, but surely there are others that you can cancel or downgrade. Some services don’t even have strict contracts and instead rely on auto-renewal. It may be time to uncheck those auto-pay options.

Reduce Your Tax Debt and Monthly Payments

Debt can be a considerable burden for any business. Your tax payments can disrupt your cash flow and cause liquidity problems. Thankfully, you can hire a tax relief company to reduce your monthly payment, and if you have the right partner, they can negotiate with the IRS and hopefully reduce your overall debt. Another great way to combat debt is to reduce the principal amount so that your interest rates are lower. If you have the spare funds available, this can represent a safe way to hedge against inflation.

Summing up the Effective Ways to Protect Your Business from Inflation

Although inflation is a significant problem for most businesses, there are ways to get through the crisis. Once you implement a frugal approach to business expenses, you will be able to find a way out of any financial downturn. Follow the advice on effective ways to protect your business from inflation outlined here, and you should outlast the inflation.

Meta description: If you are afraid of the coming economic recessions, here are some effective ways to protect your business from inflation.

Was this article helpful?

We are a team of writers and contributors with a passion for creating valuable content for small business owners, self-employed, entrepreneurs, and more.

Feel free to reach out to use as support@falconexpenses.com