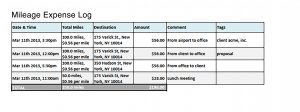

IRS Compliant Mileage Expense Log

Learn IRS requirements for a mileage expense log, what needs to be included. Tips on how to log miles; maximize your mileage tax deductions.

If you drive just 40 miles a day for business each work day of the year you can deduct over $6000 in mileage expenses.